With February behind our back, the performance on my trading was a bit disappointing. Not because of the numbers per se but due to my execution. I made too many errors on my trading this month and it cost me the difference of either being profitable or not.

On a mark-to-market basis, the account closed -3.2% for the month. I estimate my mistakes to have cost me around 10-15% which if I hadn't made them I would've end up deep in the green for the month. Mistakes were attributed to poor execution of my part, and one of them that cost me a loss of 3R (so the loss was 200% bigger than what I was willing to lose) was due to a price movement where it went well above my exit point, in which I forgot to put a stop in place.

Another mistakes were that at particular times on a few trades I got a bit biased. Especially in the currency market, where as all of you know I've been incredibly bullish for the dollar for quite sometime, so I underexposed myself on some trading signals just because they were against my bullish view of the dollar. Just because my system as telling me to go short dollar, because my bias was bullish I cut my risk to half, which is a mistake, since it was a decision based on my bias.

For this month, execution has to be key ! And later in the month we'll also have again a new shopping spree for our LMP portfolio. The portfolio is still beating the crap out of S&P, although as expected has been down as a whole since the peak of the market in January. We'll see how the month goes, and my bias tells me that in 4 weeks or so, we'll be a lot lower on the markets. This week should be the starting point of one severe downturn in my opinion. Indexes are at the brink of a new decline from the looks of it, which if confirmed, should take the S&P towards the 993-1000 points level.

Sunday, February 28, 2010

Wednesday, February 24, 2010

The Jaguars and Deflation

I hear every time, that the Fed control's whatever it wants and that itself would avoid any deflationary scenario.

I disagree. The Fed controls nothing. It is subject to social mood forces, and their actions are the reflection of the current mood of the public. It's a cause-reaction kind of thing.

For you to understand more how could deflation prevail even with the Fed as the main character and Bernanke as the star, here's a nice little explanation that EWI put up a very long time ago and it has resurfaced again:

I disagree. The Fed controls nothing. It is subject to social mood forces, and their actions are the reflection of the current mood of the public. It's a cause-reaction kind of thing.

For you to understand more how could deflation prevail even with the Fed as the main character and Bernanke as the star, here's a nice little explanation that EWI put up a very long time ago and it has resurfaced again:

"The Fed Will Stop Deflation"

I am tired of hearing people insist that the Fed can expand credit all it wants. Sometimes an analogy clarifies a subject, so let’s try one.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing Jaguar automobiles and providing them to as many people as possible. To facilitate that goal, it begins operating Jaguar plants all over the country, subsidizing production with tax money. To everyone’s delight, it offers these luxury cars for sale at 50 percent off the old price. People flock to the showrooms and buy. Later, sales slow down, so the government cuts the price in half again. More people rush in and buy. Sales again slow, so it lowers the price to $900 each. People return to the stores to buy two or three, or half a dozen. Why not? Look how cheap they are! Buyers give Jaguars to their kids and park an extra one on the lawn. Finally, the country is awash in Jaguars. Alas, sales slow again, and the government panics. It must move more Jaguars, or, according to its theory -- ironically now made fact -- the economy will recede. People are working three days a week just to pay their taxes so the government can keep producing more Jaguars. If Jaguars stop moving, the economy will stop. So the government begins giving Jaguars away. A few more cars move out of the showrooms, but then it ends. Nobody wants any more Jaguars. They don’t care if they’re free. They can’t find a use for them. Production of Jaguars ceases. It takes years to work through the overhanging supply of Jaguars. Tax collections collapse, the factories close, and unemployment soars. The economy is wrecked. People can’t afford to buy gasoline, so many of the Jaguars rust away to worthlessness. The number of Jaguars -- at best -- returns to the level it was before the program began.

The same thing can happen with credit.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing credit and providing it to as many people as possible. To facilitate that goal, it begins operating credit-production plants all over the country, called Federal Reserve Banks. To everyone’s delight, these banks offer the credit for sale at below market rates. People flock to the banks and buy. Later, sales slow down, so the banks cut the price again. More people rush in and buy. Sales again slow, so they lower the price to one percent. People return to the banks to buy even more credit. Why not? Look how cheap it is! Borrowers use credit to buy houses, boats and an extra Jaguar to park out on the lawn. Finally, the country is awash in credit. Alas, sales slow again, and the banks panic. They must move more credit, or, according to its theory -- ironically now made fact -- the economy will recede. People are working three days a week just to pay the interest on their debt to the banks so the banks can keep offering more credit. If credit stops moving, the economy will stop. So the banks begin giving credit away, at zero percent interest. A few more loans move through the tellers’ windows, but then it ends. Nobody wants any more credit. They don’t care if it’s free. They can’t find a use for it. Production of credit ceases. It takes years to work through the overhanging supply of credit. Interest payments collapse, banks close, and unemployment soars. The economy is wrecked. People can’t afford to pay interest on their debts, so many bonds deteriorate to worthlessness. The value of credit -- at best -- returns to the level it was before the program began.

Jaguars, anyone?

Tuesday, February 23, 2010

Soylent Red

Today's large downside move seems to be the next down move as said on last post. At the time, there were 2 cases made, one for an immediate decline from the 1070'ish levels, or a bounce up to 1110'ish and then a fall.

At the time it made a perfect sense to consider the immediate decline, since the possibility was big for it to happen. I ended up wrong, since that was my principal count, but soon the market gave indication that the alternative count was the one to follow. I got stopped out and since I don't play against the trend it was time to wait for the inflection point to be hit, in this case 1104 which is where I'm short from.

This, if indeed is the resume of the decline, will make leeway down to 993 pts on S&P more or less. Volatility should start increasing.

Confirmation of this scenario will come once we break 1070'ish. Now it's just a matter to sit back, relax and let the market do its' thing.

At the time it made a perfect sense to consider the immediate decline, since the possibility was big for it to happen. I ended up wrong, since that was my principal count, but soon the market gave indication that the alternative count was the one to follow. I got stopped out and since I don't play against the trend it was time to wait for the inflection point to be hit, in this case 1104 which is where I'm short from.

This, if indeed is the resume of the decline, will make leeway down to 993 pts on S&P more or less. Volatility should start increasing.

Confirmation of this scenario will come once we break 1070'ish. Now it's just a matter to sit back, relax and let the market do its' thing.

Friday, February 12, 2010

Tiny update

Not much has been going on the markets lately... it's been boring with this sort of sideways/consolidation range.

There are a few alternatives on the table that I think may be going on. Either this wave down is subdividing and we are up for a few fireworks next week, or the bounce still has some more powder left.

We have to let the market show us the path, there are times where the patterns are clear as water and we have to take action in order to take advantage of them, there are others where it's a bit fuzzy of where we are in the general scheme. These are when we should be out, waiting for the market to clear itself.

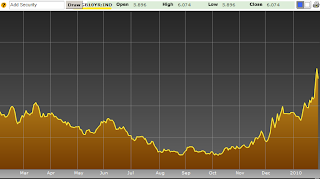

As for the US Dollar, the trend remains clearly up. Wave 3 is subdividing so I think we still have some more upside to go before a more meaningful correction, although corrections can be pretty shallow. Remember what I've said, when the larger degree trend is up, surprises happen to the upside, so, our goal is to spot bottoms not tops.

The major signals of Zé Manel on the daily, remain the same. Trend is down. Of course it can always change, but so far my bet is on the short side.

We'll see how next week develops, and I am eager to see how it will fold out

There are a few alternatives on the table that I think may be going on. Either this wave down is subdividing and we are up for a few fireworks next week, or the bounce still has some more powder left.

We have to let the market show us the path, there are times where the patterns are clear as water and we have to take action in order to take advantage of them, there are others where it's a bit fuzzy of where we are in the general scheme. These are when we should be out, waiting for the market to clear itself.

As for the US Dollar, the trend remains clearly up. Wave 3 is subdividing so I think we still have some more upside to go before a more meaningful correction, although corrections can be pretty shallow. Remember what I've said, when the larger degree trend is up, surprises happen to the upside, so, our goal is to spot bottoms not tops.

The major signals of Zé Manel on the daily, remain the same. Trend is down. Of course it can always change, but so far my bet is on the short side.

We'll see how next week develops, and I am eager to see how it will fold out

Monday, February 8, 2010

Was that the correction?

My beloved readers (both of you lol) I think we can pretty much say the trend is down, until proven otherwise.

We are on the verge of what can be a 3rd of a 3rd wave down. If you don't know what a 3rd of a 3rd wave down is, it is the most powerful place of a certain degree of trend. In this case, what I thought it could be the start of a bigger bounce on Friday may as well be all that is of the bounce. That's why the main purpose is to grab the tops and not finding the bottoms right now, because waves can always extend and rallies be very brief.

Today it marked the largest downside Advance/Decline ratio. If this were to be a 5th wave, we shouldn't have a bigger number than the one we had seen last week, but we did, hence adding more support to the 3rd of the 3rd scenario right now.

As I said a couple weeks ago, a trip to 1000-1013 points would be in the cards in a very fast manner in case of a 3rd wave, and it seems that's what may be in the cards.

The US Dollar remains the same. It's been overbought for weeks now, but I've been warning also for weeks, that the trend was up so buying every dip was the best bet and our focus was to find bottoms not tops since it could always extend and we didn't want to miss the ride up.

Do not forget when we are at a larger degree of trend, as it is the case now for USD clearly, in an uptrend surprises always happen to the upside and corrections may be very shallow and brief. That's what happened in 2008 and what appears to be happening now. We already surpassed the 80 pts in the index, and at this pace we may well reach the 90 points in a few months. That would put EURUSD at or below 1.25.

So let's keep an eye on it, and if we do get a bounce, in my opinion will be a gift of gods and I will surely be shorting it, but the market has it's tricks and as we know it likes to issue the least possible tickets for the ride - and a lot of bears would be missing the boat since most or many bears enter on short positions at bounces or retraces...

Me ? I don't care, I'm mostly a breakout kind of guys, if it shows weakness we should short since we can never know how big of a retracement it could happen or if it happens at all... food for thought everybody.

I am sorry for the lack of graphs on today's post. I will surely compensate by tomorrow with a more thorough post.

We are on the verge of what can be a 3rd of a 3rd wave down. If you don't know what a 3rd of a 3rd wave down is, it is the most powerful place of a certain degree of trend. In this case, what I thought it could be the start of a bigger bounce on Friday may as well be all that is of the bounce. That's why the main purpose is to grab the tops and not finding the bottoms right now, because waves can always extend and rallies be very brief.

Today it marked the largest downside Advance/Decline ratio. If this were to be a 5th wave, we shouldn't have a bigger number than the one we had seen last week, but we did, hence adding more support to the 3rd of the 3rd scenario right now.

As I said a couple weeks ago, a trip to 1000-1013 points would be in the cards in a very fast manner in case of a 3rd wave, and it seems that's what may be in the cards.

The US Dollar remains the same. It's been overbought for weeks now, but I've been warning also for weeks, that the trend was up so buying every dip was the best bet and our focus was to find bottoms not tops since it could always extend and we didn't want to miss the ride up.

Do not forget when we are at a larger degree of trend, as it is the case now for USD clearly, in an uptrend surprises always happen to the upside and corrections may be very shallow and brief. That's what happened in 2008 and what appears to be happening now. We already surpassed the 80 pts in the index, and at this pace we may well reach the 90 points in a few months. That would put EURUSD at or below 1.25.

So let's keep an eye on it, and if we do get a bounce, in my opinion will be a gift of gods and I will surely be shorting it, but the market has it's tricks and as we know it likes to issue the least possible tickets for the ride - and a lot of bears would be missing the boat since most or many bears enter on short positions at bounces or retraces...

Me ? I don't care, I'm mostly a breakout kind of guys, if it shows weakness we should short since we can never know how big of a retracement it could happen or if it happens at all... food for thought everybody.

I am sorry for the lack of graphs on today's post. I will surely compensate by tomorrow with a more thorough post.

Thursday, February 4, 2010

Portugalmination 2.0

The day finished at -5% here in Portugal and -6% at our neighbours Spain. Financial markets now have Portugal on the spot light due to their lack of a plan to cut the deficit which was presented to be 9,6%.

Adding the lack of competitiveness and no will to cut the government expenses of course it puts everyone nervous. When the Financial Minister came to the newspapers and saying "Poor us, now we fall pray to those damn speculators..." Sure ma man...if only we had a good economy and public finances... investors are not stupid. They see risk in Portuguese debt and that's why their fleeing to other lands and demanding a lot more yield... Don't make investors or rating agencies the expiatory goats in this matter...

As for S&P, nothing new that we haven't been following the past weeks. I could say I'm on fire...but I won't, that would be to conceded of me ( Uoopsss!! ).

This is what today felt like:

Red across all the board pretty much. And be prepared to expect a bit more of this... I think as I said a couple days ago, 1000-1013 pts might be the only stopping point now, before any meaningful bounce.

For one, I'll be awaiting tomorrow's portuguese stock market to open... will it be another blood day or will it be a hope day?

Note: Don't forget Free Week is being offered by EWI, with their paid subscriptions that are accessible free until Feb 11th, so take advantage of it ;)

Adding the lack of competitiveness and no will to cut the government expenses of course it puts everyone nervous. When the Financial Minister came to the newspapers and saying "Poor us, now we fall pray to those damn speculators..." Sure ma man...if only we had a good economy and public finances... investors are not stupid. They see risk in Portuguese debt and that's why their fleeing to other lands and demanding a lot more yield... Don't make investors or rating agencies the expiatory goats in this matter...

As for S&P, nothing new that we haven't been following the past weeks. I could say I'm on fire...but I won't, that would be to conceded of me ( Uoopsss!! ).

This is what today felt like:

Red across all the board pretty much. And be prepared to expect a bit more of this... I think as I said a couple days ago, 1000-1013 pts might be the only stopping point now, before any meaningful bounce.

For one, I'll be awaiting tomorrow's portuguese stock market to open... will it be another blood day or will it be a hope day?

Note: Don't forget Free Week is being offered by EWI, with their paid subscriptions that are accessible free until Feb 11th, so take advantage of it ;)

Portugalmination...

It seems the financial news today are all about my little country... Too bad that the reason for the spotlight to be on us is not for the best reasons, I wish they were... It seems we are now following the footsteps of Greece, and I feel sadness for my country but I have to admit our government sucks really really bad...

Yesterday morning I warned the rollover was imminent in yesterday's post:

http://www.mybullmarket.org/2010/02/bounce-is-on.html

If indeed the indexes are in the wave Î think they are, as I said last week, this decline should be stronger than the last 15 days of January. So be ready...

Yesterday morning I warned the rollover was imminent in yesterday's post:

http://www.mybullmarket.org/2010/02/bounce-is-on.html

If indeed the indexes are in the wave Î think they are, as I said last week, this decline should be stronger than the last 15 days of January. So be ready...

Wednesday, February 3, 2010

FreeWeek is back !

Our folks at EWI are back with their FREE WEEK.

From their site:

From time to time they come out with FREE WEEK which is nonetheless free access to their paid subscriptions. All you have to do is join the Free Member Club which already have a lot of educational services at no cost everyday, and you'll have access to their subscription based newsletters as long as Free Week is up.

You can follow through this link:

Or any other link on this website. Once you've logged in you can access the subscription area or access their free educational material. And from time to time (every 1-2 months or so) Free Week comes out.

As for the markets, today was a very dull day with not much going on. The S&P as per last post is bumping to the lower range of the Target Box. Anywhere from 1100-1120 have very good odds of being turning points for this upward correction.

From their site:

Elliott Wave International (EWI) is the world’s largest market forecasting firm. EWI’s 20-plus analysts provide around-the-clock forecasts of every major market in the world via the internet and proprietary web systems like Reuters and Bloomberg. EWI’s educational services include conferences, workshops, webinars, video tapes, special reports, books and one of the internet’s richest free content programs, Club EWI.

From time to time they come out with FREE WEEK which is nonetheless free access to their paid subscriptions. All you have to do is join the Free Member Club which already have a lot of educational services at no cost everyday, and you'll have access to their subscription based newsletters as long as Free Week is up.

You can follow through this link:

As for the markets, today was a very dull day with not much going on. The S&P as per last post is bumping to the lower range of the Target Box. Anywhere from 1100-1120 have very good odds of being turning points for this upward correction.

Bounce is on...but not for long

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...

It seems what I said on the last post is on. We're now at 1100 points after a launch from 1065 in S&P. So now what?

Well if you look at the graph my perspective is within the box, we'll make a top and start going down once again. That is my perspective. If indeed is correct, the decline will be more powerful than the previous one. I think a decline of 100 points is not out of the question if that turns out to happen. A decline from 1100-1115 to 1000 points-1013, which coincidently is a strong support.

Here is the graph:

Monday, February 1, 2010

Double trouble

January ended in the negative. Things don't look pretty no. There is a saying based in a pattern that says: "So goes January, so goes the year".

In fact this is true, since 1951 which is the maximum my database gets, when January was a down month either of 3 things happened:

- Flat year

- Correction bigger than 10%

- Bear market or resume of bear market.

This is true for almost 60 years which is rather amazing. So statistically speaking the maximum potential would be a flat year. My perspective as many of you know is inclined for the 3rd option. I have for long shouted out loud, that we are in a bear market rally and so far everything points to that.

Economically speaking, nothing has improved other than the usual "it stopped falling as hard the macro indicators, etc etc".

As we've seen lately with the Greece news, the markets are rather nervous. Deficits are sky high and sovereign debt costs in PIIGS countries are sky rocketing. For Greece, investors almost are counting on a default.

10 year bonds were 4+% in December... they are now 7.4% ! This is a parabolic move and something must be going on the background for this to happen... If Greece goes under I have no doubt other countries will follow suit... especially my poor little Portugal, unfortunately.

The trend according to Zé Manuel has changed in several indices. SP500 is one among them... the same for PSI-20, the home index of your fellow blogger.

I have no access to them right now but will post them later during the day.

As for our friends at EWI they have been very bearish as well, and I believe they are in the correct path and that we are in a deflationary period. All indicates to that so far...

Here's a graph from the Money Supply Aggregate and how ferociously the contraction of the monetary aggregate has been for the past 1-2 years

What about the unemployment in USA? Their policy has been to launch fuzzy numbers to the public, especially when people compare today's values to the Great Depression they don't know they're comparing different values !! Remember that comedic video I posted about the unemployment, the contest video?

We are approaching dangerously to the same figures as happened during the 30's.

That figure during the 30's was around 22-24%. We currently are under the 17.5% area.

As a final note, you know I'm not a person to advertise much. I could fill this site with affiliate banners of rather popular robots nowadays of Forex and make a cash load of money on affiliate money alone (some around the 500 USD per product). I don't do that because I don't endorse stuff I don't believe in. EWI is probably one of the few I think has their client's interests at heart. You can subscribe to their Club, which is free and you will have loads of resources, be it economic stuff or technical analysis. Reports or tutorials you name it.

As for their paid services, in my opinion they are top notch. For one reason they were the #1 Market Timer newsletter for the past 2-3 years, but what I like most is their fundamental reasoning and thought out thesis. There isn't a month where I eagerly await for their stuff to come into my mail box. Love reading it, and if you try them out I bet you'll find it worthwhile, especially now where we are at a crucial juncture in my opinion and they may be of help on these unthreaded waters that we're about to cross.

If you do join the EWI club, please do so from my banners... it is a way of you supporting this page. It is free and on their subscriptions it's 100% money back guarantee so there is no risk there. But my guess is you'll think it's worth it.

Click here to receive one of their latest reports regarding the markets for 2010:

Sorry for this blatant kind of "product plug" :-) but I'm being honest on what I said.

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...

In fact this is true, since 1951 which is the maximum my database gets, when January was a down month either of 3 things happened:

- Flat year

- Correction bigger than 10%

- Bear market or resume of bear market.

This is true for almost 60 years which is rather amazing. So statistically speaking the maximum potential would be a flat year. My perspective as many of you know is inclined for the 3rd option. I have for long shouted out loud, that we are in a bear market rally and so far everything points to that.

Economically speaking, nothing has improved other than the usual "it stopped falling as hard the macro indicators, etc etc".

As we've seen lately with the Greece news, the markets are rather nervous. Deficits are sky high and sovereign debt costs in PIIGS countries are sky rocketing. For Greece, investors almost are counting on a default.

10 year bonds were 4+% in December... they are now 7.4% ! This is a parabolic move and something must be going on the background for this to happen... If Greece goes under I have no doubt other countries will follow suit... especially my poor little Portugal, unfortunately.

I have no access to them right now but will post them later during the day.

As for our friends at EWI they have been very bearish as well, and I believe they are in the correct path and that we are in a deflationary period. All indicates to that so far...

Here's a graph from the Money Supply Aggregate and how ferociously the contraction of the monetary aggregate has been for the past 1-2 years

We are approaching dangerously to the same figures as happened during the 30's.

That figure during the 30's was around 22-24%. We currently are under the 17.5% area.

As a final note, you know I'm not a person to advertise much. I could fill this site with affiliate banners of rather popular robots nowadays of Forex and make a cash load of money on affiliate money alone (some around the 500 USD per product). I don't do that because I don't endorse stuff I don't believe in. EWI is probably one of the few I think has their client's interests at heart. You can subscribe to their Club, which is free and you will have loads of resources, be it economic stuff or technical analysis. Reports or tutorials you name it.

As for their paid services, in my opinion they are top notch. For one reason they were the #1 Market Timer newsletter for the past 2-3 years, but what I like most is their fundamental reasoning and thought out thesis. There isn't a month where I eagerly await for their stuff to come into my mail box. Love reading it, and if you try them out I bet you'll find it worthwhile, especially now where we are at a crucial juncture in my opinion and they may be of help on these unthreaded waters that we're about to cross.

If you do join the EWI club, please do so from my banners... it is a way of you supporting this page. It is free and on their subscriptions it's 100% money back guarantee so there is no risk there. But my guess is you'll think it's worth it.

Click here to receive one of their latest reports regarding the markets for 2010:

Sorry for this blatant kind of "product plug" :-) but I'm being honest on what I said.

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...

Subscribe to:

Posts (Atom)

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com