In fact this is true, since 1951 which is the maximum my database gets, when January was a down month either of 3 things happened:

- Flat year

- Correction bigger than 10%

- Bear market or resume of bear market.

This is true for almost 60 years which is rather amazing. So statistically speaking the maximum potential would be a flat year. My perspective as many of you know is inclined for the 3rd option. I have for long shouted out loud, that we are in a bear market rally and so far everything points to that.

Economically speaking, nothing has improved other than the usual "it stopped falling as hard the macro indicators, etc etc".

As we've seen lately with the Greece news, the markets are rather nervous. Deficits are sky high and sovereign debt costs in PIIGS countries are sky rocketing. For Greece, investors almost are counting on a default.

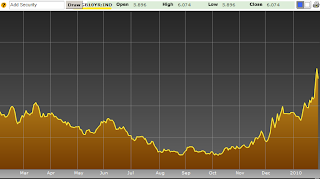

10 year bonds were 4+% in December... they are now 7.4% ! This is a parabolic move and something must be going on the background for this to happen... If Greece goes under I have no doubt other countries will follow suit... especially my poor little Portugal, unfortunately.

I have no access to them right now but will post them later during the day.

As for our friends at EWI they have been very bearish as well, and I believe they are in the correct path and that we are in a deflationary period. All indicates to that so far...

Here's a graph from the Money Supply Aggregate and how ferociously the contraction of the monetary aggregate has been for the past 1-2 years

We are approaching dangerously to the same figures as happened during the 30's.

That figure during the 30's was around 22-24%. We currently are under the 17.5% area.

As a final note, you know I'm not a person to advertise much. I could fill this site with affiliate banners of rather popular robots nowadays of Forex and make a cash load of money on affiliate money alone (some around the 500 USD per product). I don't do that because I don't endorse stuff I don't believe in. EWI is probably one of the few I think has their client's interests at heart. You can subscribe to their Club, which is free and you will have loads of resources, be it economic stuff or technical analysis. Reports or tutorials you name it.

As for their paid services, in my opinion they are top notch. For one reason they were the #1 Market Timer newsletter for the past 2-3 years, but what I like most is their fundamental reasoning and thought out thesis. There isn't a month where I eagerly await for their stuff to come into my mail box. Love reading it, and if you try them out I bet you'll find it worthwhile, especially now where we are at a crucial juncture in my opinion and they may be of help on these unthreaded waters that we're about to cross.

If you do join the EWI club, please do so from my banners... it is a way of you supporting this page. It is free and on their subscriptions it's 100% money back guarantee so there is no risk there. But my guess is you'll think it's worth it.

Click here to receive one of their latest reports regarding the markets for 2010:

Sorry for this blatant kind of "product plug" :-) but I'm being honest on what I said.

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...