Please refer to my last post about USD and our long-term calls.

This post is just a follow up and see how this last call is so far doing. Around two weeks ago I defended the Euro had topped and we were poised for a big move down in Euro (and implicitly a big move up on USD) in the following weeks.

The fact is following that post the USD has risen almost 8% now which in the currency world is a very big move already. EURUSD dropped already almost 1000 pips which is very considerable and if one were to be short that would translate into 10 000 dollars of profits per contract - a very handsome fee indeed.

Here's how the picturee has unfolded since then:

It seems that our call is on the wagon thus far... If indeed my prognostic is right, this leg that has started now should take the USD higher in a very powerful move since we are now crossing into third wave territory.

------------------------------------------------------------------------------

Disclaimer: The author holds short positions in EURUSD and long positions in USD Index. The author does not take responsibility from the actions taken by others. The opinions listed on this article are of the author only, and shall not be deemed as financial advice, or any other sort of advice. All visitors to the blog should do their own research before making any decisions. This blog, its affiliates, partners or authors are not responsible or liable for any misstatements and/or losses any one might sustain from the content provided. Author is not a registered financial advisor. Author does not engage in dispensing financial advice.

Friday, November 26, 2010

Thursday, November 25, 2010

LMP Portfolio

It has been a long time since an update in our portfolio.

We haven't added a single security in the past 6 months and in a way I am happy we didn't since a lot of our shares have gained a lot since then rising more than the index itself.

I'm not happy with one thing though, the fact that we haven't made money for the past 5 months or so due to the fact that we are hedged. I assume the responsibility of that but unfortunately I know how it is watching the markets run up and we are hedged without making any money (or very little) on the upside. Indeed our portfolio filter did have us exiting our shorts around the 1120 area (at a loss) but since I wasn't able to post it here I am counting as if the short is still on.

If we hadn't, we would be up around 75% since inception instead of the current 53'ish %. We still managed to turn out a eek 5% increase in the portfolio but we always want to achieve more here at myBullmarket.

Even with all these intrinsics and episodes around the portfolio we are still beating the S&P for the year by a reasonable margin (although we should've been demolishing it). YTD we are up +13% while S&P is up +8.9% all this by being hedged most of the year and only invested in 75% since we still do have 25% in cash.

Along the way some of our stocks have been through some changes, so if you're following us you probably noticed that DECKERS for example, one of our best performers underwent on a 3:1 stock split and Aeropostale on a 3:2 stock split as well, so all of you have seen your shares increased. That is why in the portfolio table the entry values are now different from our original entries in order to take into account those adjustments from stock splits and also dividends.

So here is how our portfolio is currently invested:

At the end of the year we will indeed need to do some rebalancing, since some of our allocations are now going out of our threshold values.

Stick with us because there is still a lot more to come.

We haven't added a single security in the past 6 months and in a way I am happy we didn't since a lot of our shares have gained a lot since then rising more than the index itself.

I'm not happy with one thing though, the fact that we haven't made money for the past 5 months or so due to the fact that we are hedged. I assume the responsibility of that but unfortunately I know how it is watching the markets run up and we are hedged without making any money (or very little) on the upside. Indeed our portfolio filter did have us exiting our shorts around the 1120 area (at a loss) but since I wasn't able to post it here I am counting as if the short is still on.

If we hadn't, we would be up around 75% since inception instead of the current 53'ish %. We still managed to turn out a eek 5% increase in the portfolio but we always want to achieve more here at myBullmarket.

Even with all these intrinsics and episodes around the portfolio we are still beating the S&P for the year by a reasonable margin (although we should've been demolishing it). YTD we are up +13% while S&P is up +8.9% all this by being hedged most of the year and only invested in 75% since we still do have 25% in cash.

Along the way some of our stocks have been through some changes, so if you're following us you probably noticed that DECKERS for example, one of our best performers underwent on a 3:1 stock split and Aeropostale on a 3:2 stock split as well, so all of you have seen your shares increased. That is why in the portfolio table the entry values are now different from our original entries in order to take into account those adjustments from stock splits and also dividends.

So here is how our portfolio is currently invested:

At the end of the year we will indeed need to do some rebalancing, since some of our allocations are now going out of our threshold values.

Stick with us because there is still a lot more to come.

Tuesday, November 23, 2010

A recall on our Dollar calls...

I've been wanting to make this post for quite sometime.

A post with our track record on the USD calls and how right we, here at myBullmarket, have been regarding the USD. We have spotted all the big moves and turning points in anticipation, sometimes MONTHS ahead.

I am of course proud of these calls, but one shouldn't take himself too seriously on these occasions. Anyhow here's a graph with our calls for the past 1.5 years:

Luckily we have been right for the most part or at all big turning points. Happily for us of course. Now where to?

Well, as I posted back then my belief was once we reached the 1.40 level we would resume our trend to the downside, so now it's anyone's guess where the Euro will go. My belief again is that ultimately we will breach the 1.20 level once again, but first things first... Before that I think in the short term we will visit the 1.25 level and the EURUSD is currently at the 1.34'ish level.

I will later make a follow-through post on this matter about the USD and also other stuff such as our LMP Portfolio (which has been pretty much flat during the past few months due to our hedged position) and some other topics.

Seat tight and enjoy.

A post with our track record on the USD calls and how right we, here at myBullmarket, have been regarding the USD. We have spotted all the big moves and turning points in anticipation, sometimes MONTHS ahead.

I am of course proud of these calls, but one shouldn't take himself too seriously on these occasions. Anyhow here's a graph with our calls for the past 1.5 years:

Luckily we have been right for the most part or at all big turning points. Happily for us of course. Now where to?

Well, as I posted back then my belief was once we reached the 1.40 level we would resume our trend to the downside, so now it's anyone's guess where the Euro will go. My belief again is that ultimately we will breach the 1.20 level once again, but first things first... Before that I think in the short term we will visit the 1.25 level and the EURUSD is currently at the 1.34'ish level.

I will later make a follow-through post on this matter about the USD and also other stuff such as our LMP Portfolio (which has been pretty much flat during the past few months due to our hedged position) and some other topics.

Seat tight and enjoy.

Tuesday, November 9, 2010

Tiiiimber !

...and silver is pretty much in the crapper now !

Last night's post it seems was exactly at the right time... check the graph on silver. It reached the mid-29's and once it touched the trendline I had up on the chart it made a big reversal... and if the rise in the past few weeks was amazing, then this reversal is jaw dropping... just refer to last night's post.

What will be of silver from now on? Well I don't know but this has a very good chance of being the reversal point for silver and ultimately for the US Dollar as well...

Last night's post it seems was exactly at the right time... check the graph on silver. It reached the mid-29's and once it touched the trendline I had up on the chart it made a big reversal... and if the rise in the past few weeks was amazing, then this reversal is jaw dropping... just refer to last night's post.

What will be of silver from now on? Well I don't know but this has a very good chance of being the reversal point for silver and ultimately for the US Dollar as well...

Return of the Jedi

Hello everyone,

After a long hiatus due to professional reasons I am back... and in force I hope. I also endured a little surgery not too long ago, but this has also passed by. The reasons are not to be alarming but nonetheless I will still have to undergo surgery one more time in a couple months but then all is set.

There is so much to talk about that I don't even know where to start. The markets in terms of the stock markets have been pretty much range bound since the last time I posted. But in the commodities arena... my oh my... there are some beauties out there... but also don't forget that beauties can turn into ugly monsters in a matter of an instant at times.

One of those beauties is SILVER.

Silver has exploded up high for the past few weeks, and lucky me I was on board for most part of when the breakout took place. But it bothers me... the pace of the rise has been pretty much parabolic and sentiment among traders in silver is sky high at 98% !! This means only 2% believe silver will go down in the future...

You, as long time readers of myBullmarket, know that when the majority is on the wagon it's usually when this one derails off course.

Silver looks to be such case... in a blow off top manner, these type of movements end in only one way, the spectacular rise gives turn to a spectacular downfall as well...

I know I know... "Oh but the FED is printing billions after billions... silver will go through the roof with so much printing". While the FED may be printing like there's no tomorrow, I'm a firm believer that markets ultimately will go wherever they want to, with FED or no FED... remember last year when everyone was advocating the downfall of the Dollar for the same reasons? "Hyperinflation this, hyperinflation that...." What happened? The dollar rallied from 74 up 'til 89 in the subsequent months, and here at myBullmarket we anticipated that move.

6 months later and with EURUSD in the crapper myBullmarket made use of the "Magazine Cover" curse, when magazine The Economist had in their cover the enterings of Leninegrad making allusion of the downfall of the Euro, and we anticipated a move upwards in the Euro for a few months. It has been 4-5 months since then, and with the Euro now at 1.40's I think we have the same type of contrarian signal once again...

The Euro looks poised to start a decline for the weeks to come and silver in my opinion... well a picture is worth a 1000 words they say...

See how the move looks parabolic? Like I said these type of moves that are spectacular in a way turn out to reverse and do it so in a spectacular fashion as well...

In the graph above we have silves again ... we may have some more room to the upside... there is strong resistance at the top of the channel around 30 USD per ounce and that may well be the point where silver reverses and starts a meaningful or a very nasty decline. Also 30 USD is also the target from the inverted H&S formation that went from 2008-2010, so we have 2 points of confluence in resistance...

Therefore I'm starting to be itchy with my position in silver and will start to scale down along the way up but always leaving a few so if a stronger trend happens to take place I will take advantage of it... but I doubt it. Although trends usually do go way beyond of what most people anticipate...

------------------------------------------------------------------------------

Disclaimer: The author holds long positions in Silver and long positions in EURUSD. The author does not take responsibility from the actions taken by others. The opinions listed on this article are of the author only, and shall not be deemed as financial advice, or any other sort of advice. All visitors to the blog should do their own research before making any decisions. This blog, its affiliates, partners or authors are not responsible or liable for any misstatements and/or losses any one might sustain from the content provided. Author is not a registered financial advisor. Author does not engage in dispensing financial advice.

After a long hiatus due to professional reasons I am back... and in force I hope. I also endured a little surgery not too long ago, but this has also passed by. The reasons are not to be alarming but nonetheless I will still have to undergo surgery one more time in a couple months but then all is set.

There is so much to talk about that I don't even know where to start. The markets in terms of the stock markets have been pretty much range bound since the last time I posted. But in the commodities arena... my oh my... there are some beauties out there... but also don't forget that beauties can turn into ugly monsters in a matter of an instant at times.

One of those beauties is SILVER.

Silver has exploded up high for the past few weeks, and lucky me I was on board for most part of when the breakout took place. But it bothers me... the pace of the rise has been pretty much parabolic and sentiment among traders in silver is sky high at 98% !! This means only 2% believe silver will go down in the future...

You, as long time readers of myBullmarket, know that when the majority is on the wagon it's usually when this one derails off course.

Silver looks to be such case... in a blow off top manner, these type of movements end in only one way, the spectacular rise gives turn to a spectacular downfall as well...

I know I know... "Oh but the FED is printing billions after billions... silver will go through the roof with so much printing". While the FED may be printing like there's no tomorrow, I'm a firm believer that markets ultimately will go wherever they want to, with FED or no FED... remember last year when everyone was advocating the downfall of the Dollar for the same reasons? "Hyperinflation this, hyperinflation that...." What happened? The dollar rallied from 74 up 'til 89 in the subsequent months, and here at myBullmarket we anticipated that move.

6 months later and with EURUSD in the crapper myBullmarket made use of the "Magazine Cover" curse, when magazine The Economist had in their cover the enterings of Leninegrad making allusion of the downfall of the Euro, and we anticipated a move upwards in the Euro for a few months. It has been 4-5 months since then, and with the Euro now at 1.40's I think we have the same type of contrarian signal once again...

The Euro looks poised to start a decline for the weeks to come and silver in my opinion... well a picture is worth a 1000 words they say...

See how the move looks parabolic? Like I said these type of moves that are spectacular in a way turn out to reverse and do it so in a spectacular fashion as well...

In the graph above we have silves again ... we may have some more room to the upside... there is strong resistance at the top of the channel around 30 USD per ounce and that may well be the point where silver reverses and starts a meaningful or a very nasty decline. Also 30 USD is also the target from the inverted H&S formation that went from 2008-2010, so we have 2 points of confluence in resistance...

Therefore I'm starting to be itchy with my position in silver and will start to scale down along the way up but always leaving a few so if a stronger trend happens to take place I will take advantage of it... but I doubt it. Although trends usually do go way beyond of what most people anticipate...

------------------------------------------------------------------------------

Disclaimer: The author holds long positions in Silver and long positions in EURUSD. The author does not take responsibility from the actions taken by others. The opinions listed on this article are of the author only, and shall not be deemed as financial advice, or any other sort of advice. All visitors to the blog should do their own research before making any decisions. This blog, its affiliates, partners or authors are not responsible or liable for any misstatements and/or losses any one might sustain from the content provided. Author is not a registered financial advisor. Author does not engage in dispensing financial advice.

Wednesday, September 1, 2010

New trade

September 1st, at the open, once again we'll short SPY at 100% the value of our portfolio. (If someones portfolio is valued currently at 25k then it should be a short worth that amount, etc).

Hope this goes better than last time.

Hope this goes better than last time.

Monday, August 2, 2010

Friday, July 2, 2010

LMP End of Week update

Though we didn't make money today, we still managed to outperform the market by a mere +0.06%.

I'm happy with the performance so far, and I hope the overlay "hedging" strategy helps you sleep better at night. Let me know, after the fact, since we've had the last couple months have been down months, if the strategy benefited you at any level. Let me know your feedback.

So far, we've been able to maintain the profits, while the market has been going down.

Another short stat for the portfolio is:

- Market return Year-to-Date: -7.35%

- LMP return Year-to-Date: +7.8%

In my opinion for such a low transaction portfolio this is a huge over performance, we are not trading, our stocks have been held around 12-13 months ! I'm happy with this...

I wish big returns for all of us in the coming years...

And to all Americans out there reading myBullmarket, I wish you a happy 4th of July !!

I'm happy with the performance so far, and I hope the overlay "hedging" strategy helps you sleep better at night. Let me know, after the fact, since we've had the last couple months have been down months, if the strategy benefited you at any level. Let me know your feedback.

So far, we've been able to maintain the profits, while the market has been going down.

Another short stat for the portfolio is:

- Market return Year-to-Date: -7.35%

- LMP return Year-to-Date: +7.8%

In my opinion for such a low transaction portfolio this is a huge over performance, we are not trading, our stocks have been held around 12-13 months ! I'm happy with this...

I wish big returns for all of us in the coming years...

And to all Americans out there reading myBullmarket, I wish you a happy 4th of July !!

Thursday, July 1, 2010

House numbers

Today the house numbers were really really bad: -30% which was a number 3 times higher than what it was expected.

This is what I've warned before and before, without the FED intervening the market just collapses. We've seen good numbers for the past 12 months, exclusively due to the programs that the FED implemented throughout the country in order to hold the prices. So, once they ended the programs back in April, we now see these numbers !

Now what will they do? Let the market function properly or intervene once more ? If they do, where will they get the money? Print it? They can't hold the prices forever... either it breaks, or they will have to print themselves out of this mess, and then face freakin' super inflation. No matter what the step is, it leads to a crisis either deflation or superinflation...

Again, the crisis is en route !

P.S - Today was another good day for the portfolio ! Despite of the decline of the markets of -0.5% and in the middle of the day the markets even got to -1.7%, the portfolio ended the day in the green at a variation of +0.53% ...

Let's hope it keeps this way on the down days ;)

A few stats:

+47.16% return since inception (dividends not included)

+24.52% annual return (dividends not included)

Portfolio vs. Market = +60.54% (dividends not included) - our overperformance from yesterday increased from the high 59.xx%'s to 60.54% an increase of almost 1% which is great !!

Market Return since inception of Portfolio: -13.38% (dividends not included)

June Market Return: -6.1%

June LMP Return: +2.02%

What does this mean? Translating it, it means that yes our stocks as a whole went declined as well, but they declined only -4.08% while the market declined more than 6%, and since we are short the market, thus the difference is our gain.

This is what I've warned before and before, without the FED intervening the market just collapses. We've seen good numbers for the past 12 months, exclusively due to the programs that the FED implemented throughout the country in order to hold the prices. So, once they ended the programs back in April, we now see these numbers !

Now what will they do? Let the market function properly or intervene once more ? If they do, where will they get the money? Print it? They can't hold the prices forever... either it breaks, or they will have to print themselves out of this mess, and then face freakin' super inflation. No matter what the step is, it leads to a crisis either deflation or superinflation...

Again, the crisis is en route !

P.S - Today was another good day for the portfolio ! Despite of the decline of the markets of -0.5% and in the middle of the day the markets even got to -1.7%, the portfolio ended the day in the green at a variation of +0.53% ...

Let's hope it keeps this way on the down days ;)

A few stats:

+47.16% return since inception (dividends not included)

+24.52% annual return (dividends not included)

Portfolio vs. Market = +60.54% (dividends not included) - our overperformance from yesterday increased from the high 59.xx%'s to 60.54% an increase of almost 1% which is great !!

Market Return since inception of Portfolio: -13.38% (dividends not included)

June Market Return: -6.1%

June LMP Return: +2.02%

What does this mean? Translating it, it means that yes our stocks as a whole went declined as well, but they declined only -4.08% while the market declined more than 6%, and since we are short the market, thus the difference is our gain.

Wednesday, June 30, 2010

LMP Update v2

We are still postponing the purchase of the new companies, which still weren't announced. They will be soon.

Apart from that, the portfolio is doing wonders so to speak. The last batch of stocks that that were bought a year ago, and sold yesterday, the average return translated into +18% (not including dividends) while the S&P during the same time period (June 2009 - June 2010) made +12.5%.

Of the 6 stocks though, the outperformance clearly came from 2 companies only, but that is to be expected. Some will underperform (usually the majority) while a couple ones will make heavy over performance covering all the underperformance of the other stocks and then some making it possible to beat the market.

Also I'm glad we did make the change on the strategy as well. The hedging part of our portfolio, where I use a longer term version of "Zé Manel" serving as an overlay to neutral our portfolio by shorting the market as a whole, while keeping our beloved stocks. Since we first started this overlay, our overperformance increased from +46% to +60% as of today !

This means that our stocks as a whole have been falling less than the market as a whole, and at times even being able to make a bit of money. Of course under this strategy the goal is not to make money, but to hedge our portfolio of market risk and to maintain our gains and for us to be dependent on our stock picks exclusively.

For example, today which was a down day for the market with more than 1% down, we actually managed to gain a few dollars with an up day of our portfolio of +0.50% ... I wish all days could be like this :) it won't... but we should keep our eyes on the big picture, and I believe we really do have a winning strategy here

EDIT: The portfolio as of today

Apart from that, the portfolio is doing wonders so to speak. The last batch of stocks that that were bought a year ago, and sold yesterday, the average return translated into +18% (not including dividends) while the S&P during the same time period (June 2009 - June 2010) made +12.5%.

Of the 6 stocks though, the outperformance clearly came from 2 companies only, but that is to be expected. Some will underperform (usually the majority) while a couple ones will make heavy over performance covering all the underperformance of the other stocks and then some making it possible to beat the market.

Also I'm glad we did make the change on the strategy as well. The hedging part of our portfolio, where I use a longer term version of "Zé Manel" serving as an overlay to neutral our portfolio by shorting the market as a whole, while keeping our beloved stocks. Since we first started this overlay, our overperformance increased from +46% to +60% as of today !

This means that our stocks as a whole have been falling less than the market as a whole, and at times even being able to make a bit of money. Of course under this strategy the goal is not to make money, but to hedge our portfolio of market risk and to maintain our gains and for us to be dependent on our stock picks exclusively.

For example, today which was a down day for the market with more than 1% down, we actually managed to gain a few dollars with an up day of our portfolio of +0.50% ... I wish all days could be like this :) it won't... but we should keep our eyes on the big picture, and I believe we really do have a winning strategy here

EDIT: The portfolio as of today

Tuesday, June 29, 2010

LMP

We sold the shares today at the open, as it was issued on Twitter and on the chat room. So far we haven't made any move regarding purchases, and I will wait it out a bit to see if the current weakness develops into more selling of the broad market or not.

Regardless of the decline, I'm happy to say that the portfolio managed to squeeze a little gain and to increase by a greater number the margin we had to the market. While last week it stood around +52.5%, today it stands at +57%. Of course, this is both a consequence of being short the broad market and at the same time our stocks as a whole are outperforming.

I will keep a close eye on the market this week and try to see, if we should get in the new equities or not.

Enjoy the good weather !!

Regardless of the decline, I'm happy to say that the portfolio managed to squeeze a little gain and to increase by a greater number the margin we had to the market. While last week it stood around +52.5%, today it stands at +57%. Of course, this is both a consequence of being short the broad market and at the same time our stocks as a whole are outperforming.

I will keep a close eye on the market this week and try to see, if we should get in the new equities or not.

Enjoy the good weather !!

Sunday, June 27, 2010

LMP update

Tomorrow at the end of the day will announce the new stocks that should replace the old ones in our portfolio. So keep an eye on the site tomorrow...

Wednesday, June 23, 2010

Epic...

Not much to say about the markets, this trading range seems to be ongoing and so far is hard to know who will win in short term, if bears or bulls...

Nonetheless, in Wimbledon something epic just happened with Mahut and Isner on the 5th set going 59-59 with 10 hours under their belt for the match... Play was suspended for the second straight day.

Nonetheless, in Wimbledon something epic just happened with Mahut and Isner on the 5th set going 59-59 with 10 hours under their belt for the match... Play was suspended for the second straight day.

Tuesday, June 15, 2010

Counter-rally done?

I was watching the price action today, and from the looks of it, at least from my perspective there is good odds that this rally may be overdone now.

In terms of Elliott Wave, the correction has been in very mushy waves, not being impulsive thus corrective... I think wave 2 may actually have ended today, where the correction took form of a ABC flat formation.

We'll see how it goes...

In terms of Elliott Wave, the correction has been in very mushy waves, not being impulsive thus corrective... I think wave 2 may actually have ended today, where the correction took form of a ABC flat formation.

We'll see how it goes...

Thursday, June 10, 2010

End of the Euro ?

Remember back in September 2009 when I posted articles talking about the doom of the dollar? At the time, the "End of the Dollar" as they called it, appeared in front covers at least in Portuguese financial media...

Well, right now, this couldn't be any more explicit:

A major economic/politic magazine with such an explicit cover, it makes a really great contrary signal. Most likely this cover will mark a bottom on the Euro as it is common on these kind of things, as I've said before the media is always the last to join a trend...

Well, right now, this couldn't be any more explicit:

A major economic/politic magazine with such an explicit cover, it makes a really great contrary signal. Most likely this cover will mark a bottom on the Euro as it is common on these kind of things, as I've said before the media is always the last to join a trend...

Tuesday, June 8, 2010

Are we in for a big run up in equities?

I can't ignore stuff like this...

Although currently we, in myBullmarket are bearish and our portfolio is hedged as well against any decline, this article makes a compelling case for a nice run up...

According to TRIN indicator the bearish move looks exhausted:

June 7 2010

Of course one, under an EW perspective could argue that since we are in the largest degree wave ever pretty much, previous records on indicators, etc, are expected to be broken... we'll see to which way does it brake.

Although currently we, in myBullmarket are bearish and our portfolio is hedged as well against any decline, this article makes a compelling case for a nice run up...

According to TRIN indicator the bearish move looks exhausted:

June 7 2010

Of course one, under an EW perspective could argue that since we are in the largest degree wave ever pretty much, previous records on indicators, etc, are expected to be broken... we'll see to which way does it brake.

Monday, June 7, 2010

Heavy reading...

I am an avid reader... I read whatever I can get my hands on, especially on what is related to markets... Today I just ordered a few books:

- Against the Gods, Peter Bernstein

- Manias, Panics and Crashes, Charles Kindleberger

- How to make money in stocks: A system for good times and bad by William O'neill (the so famed CANSLIM system method comes from this book)

- A practical guide to ETF trading systems, Anthony Garner

- The little book of behavioral investing by James Montier

- The Big Short by Michael Lewis

- Against the Gods, Peter Bernstein

- Manias, Panics and Crashes, Charles Kindleberger

- How to make money in stocks: A system for good times and bad by William O'neill (the so famed CANSLIM system method comes from this book)

- A practical guide to ETF trading systems, Anthony Garner

- The little book of behavioral investing by James Montier

- The Big Short by Michael Lewis

Sunday, June 6, 2010

Portugal first on the line?

A very interesting opinion from IEA - Institute of Economic Affairs and that I agree 'till the last word...

Portugal to be first to default

Tuesday, June 1st, 2010

The so-called Keynesian consensus that seemed to emerge following Obama’s stimulus package, was a short-lived one. Governments, mainly in the eurozone shatter belt, are dropping the same public policies they had put forth a year ago. It is not that unemployment has decreased – on the contrary. Nonetheless, “special social measures” and “job creating” public investment is being curtailed.

This should be sufficient evidence that the Keynesian answer to the crisis has failed. The Keynesian stimulus plans ignored the very low saving rates. In particular, Greece and Portugal had the lowest internal liquid savings rates (when public and private savings are added, and replacement investment deducted) of the last decade. Indeed, both countries had negative saving rates in 2008, with Portugal hitting a low of -5.8% of GDP against an EU average of 6%! It is no surprise that such highly indebted countries are now paying heavily for such leveraging.

Added to this, the Portuguese socialist government failed to understand that it should cut spending drastically. Instead, it has decided to increase taxes to respond to market worries about government borrowing. Taking into account the deep level of leveraging, both in the public and the private sector, the tax rise simply added to the risk of a banking failure, as it passed on debt from the government to households and firms, leaving the size of government untouched.

As such default probabilities on credit derivatives based on Portuguese sovereign debt remain very high; interest rates spreads are increasing; and bank refinancing is more expensive, leading to added costs for indebted firms and households, as well as to another increase in the budget deficit.

The question is: how is the government going to avoid default? Raising taxes again will be suicidal, and reducing the public sector wage bubble is anathema. Public sector wages have never been frozen in Portugal, and they are still growing. If the government does not lower them, there is no way Portugal will get out of its debt trap. I would bet on Portugal being the first eurozone country to default.

Wednesday, June 2, 2010

What I'm reading right now...

From time to time, I'll make a post of what I've been reading lately be it a book, good articles or papers...

--

The Quants by Scott Patterson

The Mania Chronicles by Robert Prechter

The little book that saves your assets by David Darst

Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein

--

The Quants by Scott Patterson

The Mania Chronicles by Robert Prechter

The little book that saves your assets by David Darst

Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein

Tuesday, May 25, 2010

Thursday, May 20, 2010

Open letter to Mrs. Merkel

It appears governments don't learn from their errors... this is why I say markets don't change. They're the same today as they were 80 years ago, as they will be 200 years from now...

Human emotions are the same, fear, greed, desperation and most importantly the effect of herding...

Anyways, here's a nice letter explaining to our dear German leader, that the markets are not the cause/root of the problem... they are only a symptom of what's wrong... and expectedly the government still has it wrong.

Human emotions are the same, fear, greed, desperation and most importantly the effect of herding...

Anyways, here's a nice letter explaining to our dear German leader, that the markets are not the cause/root of the problem... they are only a symptom of what's wrong... and expectedly the government still has it wrong.

Liebe Angie,

Kudos on your bold move to ban naked short selling in Germany. It takes a woman of real testicular fortitude to replicate the U.S.’s temporary ban on short selling in 2008, a move that worked like a charm. Sure the U.S. ban smelled desperate, backed up demand that was loosed with a fury immediately afterwards, and spooked the markets into a further slide, but it did succeed in stopping short selling during the prohibited period. As your goosing friend, W., might say, “Mission Accomplished.”

Much like a long-dead white male German who shares your initial, you know that markets always work best when the government compels investors to play nice, which, to quote an even-longer dead white male Frenchman, “means nothing less than that [they] will be forced to be free.” And excoriating speculators whose trades expose inefficiencies and re-align prices with values was a masterstroke. If only you’d connect the dots and start blaming the Jews, you could activate the Indonesian playbook that worked so well during the late-90’s Asian financial crisis.

Since at the moment you’re preoccupied with not dealing with this crisis, you may not have considered all the other societal problems that could be solved in similar fashion. Here’s a quick list:

Sanitation: Rather than having to deal with the pesky task of collecting, hauling and disposing of garbage, just attack the source of the problem: the vermin that congregate in and around the garbage. Remove the pests and the garbage takes care of itself.

Public Health: Treating disease is a costly, time-consuming and often complicated process. Instead, ignore the disease and focus on the symptoms, preferably the ones caused by the treatment rather than the disease. For example, cancer patients often lose their hair. Prescribe Rogaine and watch the cancer disappear.

Mortality: People have been trying to conquer this one for millennia, but no one’s tried the obvious: imprison undertakers. These vultures take advantage of the dead by profiting from their demise. Stop the undertakers and, ipso facto, life becomes eternal.

Crime: Confiscate all valuables. With nothing left to steal, thievery withers away.

Evil: Ban the media from reporting about bad things that happen. Once you’ve killed the messenger the message ceases to exist. And without the message, it didn’t happen.

Ugliness: It’s in the eye of the beholder, stupid. Ugly people aren’t really ugly — they’re just perceived as ugly by others. Force society to compliment every snaggle-toothed boohog on his or her appearance. Problem solved.

Erectile Dysfunction: Indict pharmaceutical companies that sell Viagra.

Incompetent Market Regulators: Crucify speculators.

I think you get the picture, Angie. There’s no end to all the problems that can be solved by applying your simple logic.

Mit freundlichen Grüßen unwahr,

Benjamin

Tuesday, May 18, 2010

EURUSD

As for the EURUSD, I'm not liking at all the price action, because... I'm long. I may have to cut my losses. The price action may be a bit different than the count I had put up before. This may still be the 3rd wave within a very big third wave...

Since I'm a bit lazy to draw a new chart right now, I'm going to put up a chart from a fellow poster from another blog. He's a very good chartist and I may have to agree with him on this one after seeing the last 2-3 sessions for the Euro, the momentum, breadth etc have been increasing by a lot making me suspicious we're still within the 3rd wave extension... If 1.20 doesn't hold, I'm out...

Here's the chart:

Since I'm a bit lazy to draw a new chart right now, I'm going to put up a chart from a fellow poster from another blog. He's a very good chartist and I may have to agree with him on this one after seeing the last 2-3 sessions for the Euro, the momentum, breadth etc have been increasing by a lot making me suspicious we're still within the 3rd wave extension... If 1.20 doesn't hold, I'm out...

Here's the chart:

Today's high...

...1149 points !

Should I make a little mind refresher?

That was last night...(apart from the "Today's high" stuff)... how can some academics say the market is random is beyond me. It's not. It's probabilistically predictable... But academics keep talking, while real people keep making money in the markets... who would you rather listen to? Sigh...

Should I make a little mind refresher?

That was last night...(apart from the "Today's high" stuff)... how can some academics say the market is random is beyond me. It's not. It's probabilistically predictable... But academics keep talking, while real people keep making money in the markets... who would you rather listen to? Sigh...

Monday, May 17, 2010

Wave 3 impending?

As for the S&P 500 here's an update:

We are at an important juncture... I think the wave patterns are pretty clear in this graph. You can see a lot of textbook 5 wave declines, even at lower degrees that are not labeled on the graph, but if you pay attention, especially wave degrees lower than the pink waves, you can see also 5 waves mostly between waves pink ii and iii.

Fractals working at their best. So, we are now at a possible juncture to a new degree third wave, in which case if it happens we should go much lower...

We are at an important juncture... I think the wave patterns are pretty clear in this graph. You can see a lot of textbook 5 wave declines, even at lower degrees that are not labeled on the graph, but if you pay attention, especially wave degrees lower than the pink waves, you can see also 5 waves mostly between waves pink ii and iii.

Fractals working at their best. So, we are now at a possible juncture to a new degree third wave, in which case if it happens we should go much lower...

What can we do to improve LMP and more stuff

There have been some worries on what could happen to LMP in case of a market meltdown.

Well, to be blunt, I would expect them to get decimated along the market of course. What we could do though, would be to whenever Zé Manel gave a sell signal, we could expose ourselves just to the alpha of LMP portfolio. What does this mean?

Simply it means that we would be "betting" on the outperformance of the portfolio versus the S&P500 even if the portfolio were to decline, if positive alpha was achieved, it would make money.

Alpha simple stating is the outperformance above the broad market that a manager/investor can create to a portfolio. So if someone would've gained 15% on his portfolio while the market gained 10%, it was said that the alpha would be +5%. Of course on any given year, this measure is useless. What is really valuable is a consistent positive alpha from managers or portfolios. This means one could go for a market neutral strategy such as being long the portfolio while short the broad market, and absorb the alpha return on itself and either make money or lose much less than the market.

Outperformance could either be a better performance on the positive side (+15% vs. +10%) as well as on the negative side( for example the manager losing -15% while the market losing -25%: this is a +10% alpha).

So what would be the most convenient, would be to be exposed both to the market returns + the alpha given by the manager whenever the market as broad is bullish and whenever it's bearish we would want to be only exposed to the alpha.

While I still haven't backtested this idea, by using Zé Manel, I'm confident it may give back positive results.

Also, I'm working on a strategy that I've been having on my mind for quite sometime... We would be using Ze' Manel as well in order to time diferent indexes and so far the results look promising, although the resolution of the backtest so far is yearly only, I will provide soon enough results with more resolution with weekly data points, in order to have better measures on drawdowns, etc.

The returns though, clearly look much stronger than a passive buy and hold on the market including the dividends paid.

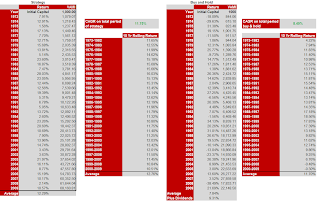

There is a problem for a person to remain disciplined with this strategy. As you can see, the average return of the strategy is very very stable both on arithmetic average as well as on CAGR.

Also take a look at the 10 year rolling period returns. Both on buy and hold and the strategy. The strategy would've underperformed during most of the 90's. Would you have stuck with the strategy at that time? The main secret here is not to gain big... it's to maintain a stability and not to lose much when bad times come around. Also the buy and hold returns during the 90's, I would say they are difficult to be repeated as it was the biggest bull market in human history... Well, at least I don't expect such euphoria anytime soon. And stability pays off... check the last 10 year rolling period which stands for the annual returns for the 2000-2009 period.

The 10 Yr Rolling returns, are much more realistic from an investor standpoint since investors don't invest all at same time, and a high CAGR could be due to early big gains on a time series. For example look at Warren Buffet. His long term return is 22% a year. Does this mean people investing on him would achieve that? Not likely, most of that 22% return is concentrated in his early days and a 10 Yr Rolling period is much more transparent when it comes to assessing the robustness of an investing strategy and what an investor could expect in a long term investment of 10 years for example beginning at anytime (although past performances are no guarantee of future performances of course).

VAMI is simply the Value Added Monthly Index, and tracks an hypothetical $1000 investment at the beginning of the period. In this case $1000 would have turned into $68,000+.

Of course since the risk adjusted returns are way bigger on the strategy, so one could leverage it up 1.5x or even 2x's. Although the drawdown would be bigger than the one from unleveraged, this would still be about less than half of the S&P. I mean most people in 2008 suffered through 60% drawdowns, isn't that nerve wrecking ?

Even if a strategy doesn't make as much CAGR as buy and hold (which this does more actually), wouldn't you rather have a 9-10 annual return with much lower downside, than have 11-12% returns with chances to watch your account being cut in half ?

I know I would...

Well, to be blunt, I would expect them to get decimated along the market of course. What we could do though, would be to whenever Zé Manel gave a sell signal, we could expose ourselves just to the alpha of LMP portfolio. What does this mean?

Simply it means that we would be "betting" on the outperformance of the portfolio versus the S&P500 even if the portfolio were to decline, if positive alpha was achieved, it would make money.

Alpha simple stating is the outperformance above the broad market that a manager/investor can create to a portfolio. So if someone would've gained 15% on his portfolio while the market gained 10%, it was said that the alpha would be +5%. Of course on any given year, this measure is useless. What is really valuable is a consistent positive alpha from managers or portfolios. This means one could go for a market neutral strategy such as being long the portfolio while short the broad market, and absorb the alpha return on itself and either make money or lose much less than the market.

Outperformance could either be a better performance on the positive side (+15% vs. +10%) as well as on the negative side( for example the manager losing -15% while the market losing -25%: this is a +10% alpha).

So what would be the most convenient, would be to be exposed both to the market returns + the alpha given by the manager whenever the market as broad is bullish and whenever it's bearish we would want to be only exposed to the alpha.

While I still haven't backtested this idea, by using Zé Manel, I'm confident it may give back positive results.

Also, I'm working on a strategy that I've been having on my mind for quite sometime... We would be using Ze' Manel as well in order to time diferent indexes and so far the results look promising, although the resolution of the backtest so far is yearly only, I will provide soon enough results with more resolution with weekly data points, in order to have better measures on drawdowns, etc.

The returns though, clearly look much stronger than a passive buy and hold on the market including the dividends paid.

There is a problem for a person to remain disciplined with this strategy. As you can see, the average return of the strategy is very very stable both on arithmetic average as well as on CAGR.

Also take a look at the 10 year rolling period returns. Both on buy and hold and the strategy. The strategy would've underperformed during most of the 90's. Would you have stuck with the strategy at that time? The main secret here is not to gain big... it's to maintain a stability and not to lose much when bad times come around. Also the buy and hold returns during the 90's, I would say they are difficult to be repeated as it was the biggest bull market in human history... Well, at least I don't expect such euphoria anytime soon. And stability pays off... check the last 10 year rolling period which stands for the annual returns for the 2000-2009 period.

The 10 Yr Rolling returns, are much more realistic from an investor standpoint since investors don't invest all at same time, and a high CAGR could be due to early big gains on a time series. For example look at Warren Buffet. His long term return is 22% a year. Does this mean people investing on him would achieve that? Not likely, most of that 22% return is concentrated in his early days and a 10 Yr Rolling period is much more transparent when it comes to assessing the robustness of an investing strategy and what an investor could expect in a long term investment of 10 years for example beginning at anytime (although past performances are no guarantee of future performances of course).

VAMI is simply the Value Added Monthly Index, and tracks an hypothetical $1000 investment at the beginning of the period. In this case $1000 would have turned into $68,000+.

Of course since the risk adjusted returns are way bigger on the strategy, so one could leverage it up 1.5x or even 2x's. Although the drawdown would be bigger than the one from unleveraged, this would still be about less than half of the S&P. I mean most people in 2008 suffered through 60% drawdowns, isn't that nerve wrecking ?

Even if a strategy doesn't make as much CAGR as buy and hold (which this does more actually), wouldn't you rather have a 9-10 annual return with much lower downside, than have 11-12% returns with chances to watch your account being cut in half ?

I know I would...

Friday, May 14, 2010

Bull's Eye

After the past 10 months I've been commenting about the 1.23 level. We are now under that territory at 1.23 and a few sprinkles.

With the overextended pessimism going on, and the naysayers, I am becoming more confident we'll see a big rebound soon. Looking at the structure, the 5th wave extension keeps ongoing, but it is my view it will soon be over in order to give place for a rebound.

Anyways, since the trade is so overcrowded now, I am starting to build a long position on € against the $. Needless to say that I am going against the trend right now, so it's a bit swimming against the current. But at times, when extremes happen, one has to know when to stop. I think we are under such circumstances right now... I will keep adding new positions on the way down. Note, that I'm not averaging down, I have already established my risk on this trade, but instead of going all in I am scaling in until my total risk position is filled.

Here's a weekly current view of Euro:

With the overextended pessimism going on, and the naysayers, I am becoming more confident we'll see a big rebound soon. Looking at the structure, the 5th wave extension keeps ongoing, but it is my view it will soon be over in order to give place for a rebound.

Anyways, since the trade is so overcrowded now, I am starting to build a long position on € against the $. Needless to say that I am going against the trend right now, so it's a bit swimming against the current. But at times, when extremes happen, one has to know when to stop. I think we are under such circumstances right now... I will keep adding new positions on the way down. Note, that I'm not averaging down, I have already established my risk on this trade, but instead of going all in I am scaling in until my total risk position is filled.

Here's a weekly current view of Euro:

Wednesday, May 12, 2010

Update on LMP

After the sell off last week, we were able to buy the stocks we have wanted to add to our portfolio for quite sometime.

Unfortunately, we weren't able to take advantage of the -10% intraday move. That would have been a great move, but since this is an end of day portfolio, where our purchases are made at open prices, buying the shares during an intraday move is dishonest since it's not replicable and I could easily say I bought at the bottom.

This way, buying at open, is not only repplicable but also the most transparent way in my opinion to display the results, other than through an audited track record.

Anyway's, it seems that our wait paid of, since before we were beating the S&P500 by 44% points, and today we are beating the S&P by 51.22% points, which translates to an increase of 7.22% on our overperformance.

Let's hope the portfolio keeps overperforming in the future.

So far this is how the portfolio stands:

Unfortunately, we weren't able to take advantage of the -10% intraday move. That would have been a great move, but since this is an end of day portfolio, where our purchases are made at open prices, buying the shares during an intraday move is dishonest since it's not replicable and I could easily say I bought at the bottom.

This way, buying at open, is not only repplicable but also the most transparent way in my opinion to display the results, other than through an audited track record.

Anyway's, it seems that our wait paid of, since before we were beating the S&P500 by 44% points, and today we are beating the S&P by 51.22% points, which translates to an increase of 7.22% on our overperformance.

Let's hope the portfolio keeps overperforming in the future.

So far this is how the portfolio stands:

Thursday, May 6, 2010

Finally...!

Today's move was crazy. Although a very good day for me... probably one of the best ever in the trading department.

With today's move I was so eager I could buy the stocks to LMP during intraday, but that would be to break the rules for soomeone that follows us, since not everyone is able to follow the markets intraday. LMP stands for transparency of our purchases, so ALL purchases are made at the open price, so the portfolio can be easily replicated by anyone...

So tomorrow we will be buying at the open the following stocks:

- WTW

- APOL

- FWLT

- SOLR

- SOHU

All in all we're gonna have a bit of discount compared to March. Although my belief is that this selling cycle is not over yet, and it may as well be a new longer term downtrend... but let's not think of that right now.

Have a look at this thing:

Good luck everyone.

With today's move I was so eager I could buy the stocks to LMP during intraday, but that would be to break the rules for soomeone that follows us, since not everyone is able to follow the markets intraday. LMP stands for transparency of our purchases, so ALL purchases are made at the open price, so the portfolio can be easily replicated by anyone...

So tomorrow we will be buying at the open the following stocks:

- WTW

- APOL

- FWLT

- SOLR

- SOHU

All in all we're gonna have a bit of discount compared to March. Although my belief is that this selling cycle is not over yet, and it may as well be a new longer term downtrend... but let's not think of that right now.

Have a look at this thing:

Good luck everyone.

Black Swan

Ladies and gentleman...

We have ourselves a black swan event (well not so much but I just wanted to post this...):

We have ourselves a black swan event (well not so much but I just wanted to post this...):

Panic Mode

We are now on panic mode...

I don't know if this was a bad tick on the data, but I doubt it since it was across ALL BOARD... I saw Apple going -20% and S&P touching 1050's which is a -10% decline !!!

I'll update more stuff in a few...

I don't know if this was a bad tick on the data, but I doubt it since it was across ALL BOARD... I saw Apple going -20% and S&P touching 1050's which is a -10% decline !!!

I'll update more stuff in a few...

Euro and Market Psychology

A little update in the €uro, now that we're almost reaching our target, I think it's appropriate to make an update.

For the past 6 months, the EUR/USD has been declining relentlessly from 1.50 to around 1.28. It was such a nice move. Trendy, with not many retraces, etc.

All in all, a 2200 pip move, which I hope most of you were able to grab. Now what for the EURUSD?

Well, here's a graph updated with EW labels and my expectations to the mid-term future:

As you can see, the structure is beautifully textbook: 5 waves down, with what appears to be an extended 5th.

In terms of psychology, it is behaving just as predicted, and here EW can be of help too. Let me quote Robert Prechter in EWP and wave personalities:

The quotes are of course under a bullish view, so you just have to switch the adjectives to the opposite side, so instead of saying "increasingly favorable (....) as confidence returns" we would say "increasingly unfavourable as fear returns". The same for the fifth wave.

So let's take this into what happened since the high. We have the wave (3) in red which as we can see was the strongest part of the move in terms of breadth, and where fundamentals started to deteriorate, as also at that time the trend was unmistakable.

Then, it came wave (5), which is the current wave we are, although it's almost finished. Again, during 5th waves PESSIMIS runs extremely high despite narrowing of breadth. This is the time, where the public acknowledges what is going on. Fundamentals are at its' worst, and the euro is on the spotlight on the media, etc.

What has been going on since wave 5 on media? We now see inumerous economists calling for the end of the €uro, fundamentals are at its' worst with Greece pretty much in ruin. Portugal is pretty much going through the same path as well, although not as bad as Greece... yet.

Newspapers, and not only the financial ones, give notoriety to doom and gloomers and other financial talkheads at this point, everyone is now calling for the end of Europe and Greece and €uro currency, riots and manifestations in Greece, talk about ultimate pessimism...

For the past 2-3 weeks all I've been seeing on TV, and other types of media is everyone so bearish on Euro right now. Today, when reading a newspaper, 10 economists were calling for the end of the Euro. Tell me about pessimism...

I only ask: Where were the talking heads calling for the end of € when it was trading at 1.50 ? At that time, of course optimism reigned. We were as well in a fifth wave, but on the opposite side (bullish) so everyone was optimistic on the €. I saw people calling for values of 2.00 for the EUR/USD.

So what to expect now that pessimism took over pretty much everyone? It's time for the market to do the exact opposite thing.

I think, we are still missing one more down wave, as in the graph I posted, to conclude the wave structure. This may take us to the 1.25 level which is a strong support. Nevertheless, my view is the next big move will be to the upside, not the downside.

As for a target on the upside, well since it will be a corrective wave, the structure is a lot more difficult to predict, but the target box is a good figure of the target, especially the mid-line of the box around the 1.390ish area.

At the middle of wave [2] of course, fundamentals will stop deteriorating or at least will have that appearance. The Euro may lose the spotlight for a bit, when people will think the worst is now over...

Again quoting Robert Prechter on waves personalities (again this is under a bullish view so you have to switch the adjectives around... since waves 2 under a bullish view is a down wave, the adjectives are negative in here... so under a bearish view a wave 2 will have positive characteristics in terms of psychology):

For the past 6 months, the EUR/USD has been declining relentlessly from 1.50 to around 1.28. It was such a nice move. Trendy, with not many retraces, etc.

All in all, a 2200 pip move, which I hope most of you were able to grab. Now what for the EURUSD?

Well, here's a graph updated with EW labels and my expectations to the mid-term future:

As you can see, the structure is beautifully textbook: 5 waves down, with what appears to be an extended 5th.

In terms of psychology, it is behaving just as predicted, and here EW can be of help too. Let me quote Robert Prechter in EWP and wave personalities:

Third Waves - Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. Increasingly favorable fundamentals enter the picture as confidence returns.[...] Strength. Breadth. Best fundamentals. Increasing real prosperity. By the end, the underlying trend is considered up.

Fifth Waves - Fifth waves are always less dynamic than third waves in terms of breadth. They usually display slower maximum speed of price change as well, although if a fifth wave is an extension, speed of price change in the third of the fifth can exceed that of the third wave. (...) Even if a fifth wave extends, the fifth of the fifth will lack the dynamism that preceded it. During advancing fifth waves, optimism runs extremely high despite narrowing of breadth. Market performance and fundamentals improve, but not to levels of wave 3. Psychology creates overvaluation

The quotes are of course under a bullish view, so you just have to switch the adjectives to the opposite side, so instead of saying "increasingly favorable (....) as confidence returns" we would say "increasingly unfavourable as fear returns". The same for the fifth wave.

So let's take this into what happened since the high. We have the wave (3) in red which as we can see was the strongest part of the move in terms of breadth, and where fundamentals started to deteriorate, as also at that time the trend was unmistakable.

Then, it came wave (5), which is the current wave we are, although it's almost finished. Again, during 5th waves PESSIMIS runs extremely high despite narrowing of breadth. This is the time, where the public acknowledges what is going on. Fundamentals are at its' worst, and the euro is on the spotlight on the media, etc.

What has been going on since wave 5 on media? We now see inumerous economists calling for the end of the €uro, fundamentals are at its' worst with Greece pretty much in ruin. Portugal is pretty much going through the same path as well, although not as bad as Greece... yet.

Newspapers, and not only the financial ones, give notoriety to doom and gloomers and other financial talkheads at this point, everyone is now calling for the end of Europe and Greece and €uro currency, riots and manifestations in Greece, talk about ultimate pessimism...

For the past 2-3 weeks all I've been seeing on TV, and other types of media is everyone so bearish on Euro right now. Today, when reading a newspaper, 10 economists were calling for the end of the Euro. Tell me about pessimism...

I only ask: Where were the talking heads calling for the end of € when it was trading at 1.50 ? At that time, of course optimism reigned. We were as well in a fifth wave, but on the opposite side (bullish) so everyone was optimistic on the €. I saw people calling for values of 2.00 for the EUR/USD.

So what to expect now that pessimism took over pretty much everyone? It's time for the market to do the exact opposite thing.

I think, we are still missing one more down wave, as in the graph I posted, to conclude the wave structure. This may take us to the 1.25 level which is a strong support. Nevertheless, my view is the next big move will be to the upside, not the downside.

As for a target on the upside, well since it will be a corrective wave, the structure is a lot more difficult to predict, but the target box is a good figure of the target, especially the mid-line of the box around the 1.390ish area.

At the middle of wave [2] of course, fundamentals will stop deteriorating or at least will have that appearance. The Euro may lose the spotlight for a bit, when people will think the worst is now over...

Again quoting Robert Prechter on waves personalities (again this is under a bullish view so you have to switch the adjectives around... since waves 2 under a bullish view is a down wave, the adjectives are negative in here... so under a bearish view a wave 2 will have positive characteristics in terms of psychology):

Second waves often retrace so much of wave one that most of the profits gained up to that time are eroded away. This is especially true of call option purchases, as premiums sink drastically in the environment of fear during second waves. At this point, investors are thoroughly convinced that the bear market is back to stay. Fundamental conditions often as bad as or worse than those at the previous bottom. Underlying trend considered down. Does not carry to new low.But once this wave [2] is over, wave [3] will begin...and at that time the downtrend will be unmistakable to anyone and the crisis will be already deep ingrained...

Wednesday, May 5, 2010

Look at that... target almost hit...

Look at that !

Remember the trolls last year claiming for the end of the US Dollar? Where are they now? Where is hyperinflation that would send the dollar down the toilet? I don't see them...

Today the Euro hit 1.28 against the dollar. My long term target last year was below the 1.24 area as minimum target. We are now almost hitting that target...

Here's a snapshot for prosperity:

Here's the graph posted back in February claiming a rise to 85 level on USD Index. This level may be indeed a mid-term top for USD (bottom for € in this case):

Remember the trolls last year claiming for the end of the US Dollar? Where are they now? Where is hyperinflation that would send the dollar down the toilet? I don't see them...

Today the Euro hit 1.28 against the dollar. My long term target last year was below the 1.24 area as minimum target. We are now almost hitting that target...

Here's a snapshot for prosperity:

Here's the graph posted back in February claiming a rise to 85 level on USD Index. This level may be indeed a mid-term top for USD (bottom for € in this case):

Tuesday, May 4, 2010

Music on loop...

After a short-selling ban from the Greek government last week, we knew what would happen. We know better, and it seems the politicians can't figure it out themselves. I really don't know who teaches economics and other things to them.

So, history doesn't repeat, but it often rhymes. Well, just like any other time, when the government banned shorts, this measures had done nothing to prevent the declines...

I bet the greek politicians are scratching their heads right now:

Today the Greek stock market fell -7% ... seriously when will these guys learn a thing or two?

But no problem, we rather use the government's decisions as contrarian signals ... :

So, history doesn't repeat, but it often rhymes. Well, just like any other time, when the government banned shorts, this measures had done nothing to prevent the declines...

I bet the greek politicians are scratching their heads right now:

Ok we can't blame the short sellers now, who should we blame then? Easter bunny perhaps?

Today the Greek stock market fell -7% ... seriously when will these guys learn a thing or two?

But no problem, we rather use the government's decisions as contrarian signals ... :

Monday, May 3, 2010

Sunday, May 2, 2010

Tuesday, April 27, 2010

Πορτογαλία

The title is not a mistake.

It stands for "Portugal" in Greek. Yup that's right. Portuguese debt was today downgraded 2 ratings by S&P, and few minutes after, S&P cut Greece's bonds to JUNK bonds (a ratting lower than BBB-).

I keep saying over and over again, that Portugal is at the brink of collapse. Our ignorant governants of course all they do is blame the evil speculators, instead of doing their job, which is to balance the freaking finances.

PSI-20 today crashed -5.4%, while Greece declined 7/8% if I am not mistaken...

This was last night's graph of the Portuguese index:

I said yesterday, there was no freakin' reason to want to be invested in PSI-20, and I guess it was for a good reason. Today we closed at around 7,000 points, which pretty much is the bottom of the previous graph...

As for Greece, remember the graph I posted last week with a Head and Shoulders pattern... now the index stands like this:

I will say it again, don't try to catch a falling knife...

Είμαστε πατήσαμε (We are fu----)

It stands for "Portugal" in Greek. Yup that's right. Portuguese debt was today downgraded 2 ratings by S&P, and few minutes after, S&P cut Greece's bonds to JUNK bonds (a ratting lower than BBB-).

I keep saying over and over again, that Portugal is at the brink of collapse. Our ignorant governants of course all they do is blame the evil speculators, instead of doing their job, which is to balance the freaking finances.

PSI-20 today crashed -5.4%, while Greece declined 7/8% if I am not mistaken...

This was last night's graph of the Portuguese index:

I said yesterday, there was no freakin' reason to want to be invested in PSI-20, and I guess it was for a good reason. Today we closed at around 7,000 points, which pretty much is the bottom of the previous graph...

As for Greece, remember the graph I posted last week with a Head and Shoulders pattern... now the index stands like this:

I will say it again, don't try to catch a falling knife...

Είμαστε πατήσαμε (We are fu----)

Monday, April 26, 2010

For my fellow portuguese investors...

For my fellow portuguese investors it seems the PSI-20 is not looking for a rest at all.

After a sell signal last week, it has already gone down 6.7%, and as far I can see there is no reason at all to be investing in PSI yet.

EDP-Renováveis which is the third biggest company in terms of renewable energies in the world, is not attractive at all at this moment and I can't understand how so many portuguese investors love to buy a falling knife...

I don't know when will this correction on PSI-20 will end, hey, it may well be the new leg of a bear market.

And just for curiosity, if past holds any truth, PSI-20 index, since its' creation has been an excellent prognosticator of what is to come to the world indexes. Usually the portuguese index breaks first than the more renown indexes such as S&P 500, etc.

But this time... this time may be different...

After a sell signal last week, it has already gone down 6.7%, and as far I can see there is no reason at all to be investing in PSI yet.

EDP-Renováveis which is the third biggest company in terms of renewable energies in the world, is not attractive at all at this moment and I can't understand how so many portuguese investors love to buy a falling knife...

I don't know when will this correction on PSI-20 will end, hey, it may well be the new leg of a bear market.

And just for curiosity, if past holds any truth, PSI-20 index, since its' creation has been an excellent prognosticator of what is to come to the world indexes. Usually the portuguese index breaks first than the more renown indexes such as S&P 500, etc.

But this time... this time may be different...

Up up away...

After last week, when Greece activated financial help, bonds decreased from 8.8% yield to low 8% which is huge move.

It was to be expected of course. The same way it was to be expected that in the bigger picture that would have NO IMPACT at all. After that decline, the trend just resumed and the 10 Year Bonds are now trading at 9.4% while the 2 Year Bonds at 13%...

Today's Greek bond chart.

The Euro on the other hand, pretty much since we at this website advocated for a large move on the dollar, it has gone down from 1.50'ish and is now trading in the low 1.30'ish.

We're on our way for the Euro to trade below 2008 level of 1.23'ish.

It was to be expected of course. The same way it was to be expected that in the bigger picture that would have NO IMPACT at all. After that decline, the trend just resumed and the 10 Year Bonds are now trading at 9.4% while the 2 Year Bonds at 13%...

Today's Greek bond chart.

The Euro on the other hand, pretty much since we at this website advocated for a large move on the dollar, it has gone down from 1.50'ish and is now trading in the low 1.30'ish.

We're on our way for the Euro to trade below 2008 level of 1.23'ish.

Friday, April 23, 2010

If only I could win the lottery...

April 23 (Bloomberg) -- Greece called for activation of a financial lifeline of as much as 45 billion euros ($60 billion) in an unprecedented test of the euro’s stability and European political cohesion.

The appeal for help from the European Union and International Monetary Fund follows a surge in borrowing costs to what Greek Prime Minister George Papandreou called unsustainable levels that undermine efforts to cut a budget deficit of more than four times the EU limit. Greek bonds rebounded and the euro rose.

“It is a matter of national need to ask officially” for the activation of the EU-led aid mechanism, Papandreou said in a televised address from the Greek island of Kastelorizo.

With national debt of almost 300 billion euros and bond yields exceeding junk-rated nations such as the Philippines, Greece faces a fiscal mess that threatened to spread to Spain and Portugal, forcing the EU to set up a standby aid facility. At stake is the future of the euro 11 years after its creators gave the European Central Bank responsibility for interest rates while leaving fiscal policy in national capitals.

The request came one day after the yield on the country’s benchmark two-year note topped 11 percent, nearing that of Pakistan, and Moody’s Investors Service lowered Greece’s creditworthiness by one notch to A3, saying it was considering a further cut to junk.

After Papandreou’s announcement, the 2-year yield, which yesterday rose above 10 percent, declined 82 basis points to 9.481 percent. The euro snapped six days of declines to rise 0.1 percent to $1.3309.

Yup. Like I said a few months ago, it was only a matter of time for Greece to ask for a bailout. Today was it.

Thursday, April 22, 2010

Intraday update

And the news keep coming...

The 2 year notes for Greece have hit 10% today. And Moody's cut Greece's debt rating as well.

And the yield curve of the greek bonds are as follow:

So we are now in the presence of an inverted yield curve from the 2YR maturity onward.

In other words, a default is expected in the long term, but not without a bailout first in the short term.

Edit: I had seen this pattern develop a long time ago, but now is even more noticeable the perfect breakout of the neckline followed by a test of the neckline which failed to break, making this H&S pattern a valid one, with target at around 1175 points on the Greek index.

This means a decline of 40'ish % still to follow on the Greek exchange ! To be honest this H&S is super perfect and a beauty to be seen.

The 2 year notes for Greece have hit 10% today. And Moody's cut Greece's debt rating as well.

And the yield curve of the greek bonds are as follow:

So we are now in the presence of an inverted yield curve from the 2YR maturity onward.

In other words, a default is expected in the long term, but not without a bailout first in the short term.

Edit: I had seen this pattern develop a long time ago, but now is even more noticeable the perfect breakout of the neckline followed by a test of the neckline which failed to break, making this H&S pattern a valid one, with target at around 1175 points on the Greek index.

This means a decline of 40'ish % still to follow on the Greek exchange ! To be honest this H&S is super perfect and a beauty to be seen.

Tic Tac Encore !

I hear every so often lately people asking me: "Should I buy Greek bonds?" , "They're cheap..." , "Default is unlikely..." etc etc.

The truth is, more than a year ago I said the next crisis would become evident on sovereign debt. At the time, you couldn't find anything on the media. 4-5 months ago, Greece wasn't even a topic of conversation. Once the debt problems escalated to the public knowledge the greek Prime-Minister came to public staying that Greece didn't have any problems. They had it under control and wouldn't need help from either EU or IMF.

4 months later he is quiet as a mouse. This after a scandal of crooked accounts by the Finances department of the country in order to hide the real numbers from EU.

Now Greece looks to be the hot topic for every John Smith around the world, like suddenly they are top experts. I see a lot of retail public saying they want to buy Greek bonds. This has been on the past 2 weeks where yields at the time were under 7%, and of course we know how the public is wrong most of the times.

Yields don't stop escalating. They are now on the 8.6% area... An intervention will have to take place sometime, probably it will be during the weekend in a concerted effort by the EU and IMF most likely to bailout Greece this weekend.