I've been wanting to make this post for quite sometime.

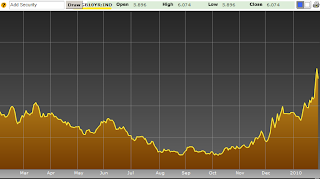

A post with our track record on the USD calls and how right we, here at myBullmarket, have been regarding the USD. We have spotted all the big moves and turning points in anticipation, sometimes MONTHS ahead.

I am of course proud of these calls, but one shouldn't take himself too seriously on these occasions. Anyhow here's a graph with our calls for the past 1.5 years:

Luckily we have been right for the most part or at all big turning points. Happily for us of course. Now where to?

Well, as I posted back then my belief was once we reached the 1.40 level we would resume our trend to the downside, so now it's anyone's guess where the Euro will go. My belief again is that ultimately we will breach the 1.20 level once again, but first things first... Before that I think in the short term we will visit the 1.25 level and the EURUSD is currently at the 1.34'ish level.

I will later make a follow-through post on this matter about the USD and also other stuff such as our LMP Portfolio (which has been pretty much flat during the past few months due to our hedged position) and some other topics.

Seat tight and enjoy.

Showing posts with label Big Picture. Show all posts

Showing posts with label Big Picture. Show all posts

Tuesday, November 23, 2010

Tuesday, November 9, 2010

Tiiiimber !

...and silver is pretty much in the crapper now !

Last night's post it seems was exactly at the right time... check the graph on silver. It reached the mid-29's and once it touched the trendline I had up on the chart it made a big reversal... and if the rise in the past few weeks was amazing, then this reversal is jaw dropping... just refer to last night's post.

What will be of silver from now on? Well I don't know but this has a very good chance of being the reversal point for silver and ultimately for the US Dollar as well...

Last night's post it seems was exactly at the right time... check the graph on silver. It reached the mid-29's and once it touched the trendline I had up on the chart it made a big reversal... and if the rise in the past few weeks was amazing, then this reversal is jaw dropping... just refer to last night's post.

What will be of silver from now on? Well I don't know but this has a very good chance of being the reversal point for silver and ultimately for the US Dollar as well...

Return of the Jedi

Hello everyone,

After a long hiatus due to professional reasons I am back... and in force I hope. I also endured a little surgery not too long ago, but this has also passed by. The reasons are not to be alarming but nonetheless I will still have to undergo surgery one more time in a couple months but then all is set.

There is so much to talk about that I don't even know where to start. The markets in terms of the stock markets have been pretty much range bound since the last time I posted. But in the commodities arena... my oh my... there are some beauties out there... but also don't forget that beauties can turn into ugly monsters in a matter of an instant at times.

One of those beauties is SILVER.

Silver has exploded up high for the past few weeks, and lucky me I was on board for most part of when the breakout took place. But it bothers me... the pace of the rise has been pretty much parabolic and sentiment among traders in silver is sky high at 98% !! This means only 2% believe silver will go down in the future...

You, as long time readers of myBullmarket, know that when the majority is on the wagon it's usually when this one derails off course.

Silver looks to be such case... in a blow off top manner, these type of movements end in only one way, the spectacular rise gives turn to a spectacular downfall as well...

I know I know... "Oh but the FED is printing billions after billions... silver will go through the roof with so much printing". While the FED may be printing like there's no tomorrow, I'm a firm believer that markets ultimately will go wherever they want to, with FED or no FED... remember last year when everyone was advocating the downfall of the Dollar for the same reasons? "Hyperinflation this, hyperinflation that...." What happened? The dollar rallied from 74 up 'til 89 in the subsequent months, and here at myBullmarket we anticipated that move.

6 months later and with EURUSD in the crapper myBullmarket made use of the "Magazine Cover" curse, when magazine The Economist had in their cover the enterings of Leninegrad making allusion of the downfall of the Euro, and we anticipated a move upwards in the Euro for a few months. It has been 4-5 months since then, and with the Euro now at 1.40's I think we have the same type of contrarian signal once again...

The Euro looks poised to start a decline for the weeks to come and silver in my opinion... well a picture is worth a 1000 words they say...

See how the move looks parabolic? Like I said these type of moves that are spectacular in a way turn out to reverse and do it so in a spectacular fashion as well...

In the graph above we have silves again ... we may have some more room to the upside... there is strong resistance at the top of the channel around 30 USD per ounce and that may well be the point where silver reverses and starts a meaningful or a very nasty decline. Also 30 USD is also the target from the inverted H&S formation that went from 2008-2010, so we have 2 points of confluence in resistance...

Therefore I'm starting to be itchy with my position in silver and will start to scale down along the way up but always leaving a few so if a stronger trend happens to take place I will take advantage of it... but I doubt it. Although trends usually do go way beyond of what most people anticipate...

------------------------------------------------------------------------------

Disclaimer: The author holds long positions in Silver and long positions in EURUSD. The author does not take responsibility from the actions taken by others. The opinions listed on this article are of the author only, and shall not be deemed as financial advice, or any other sort of advice. All visitors to the blog should do their own research before making any decisions. This blog, its affiliates, partners or authors are not responsible or liable for any misstatements and/or losses any one might sustain from the content provided. Author is not a registered financial advisor. Author does not engage in dispensing financial advice.

After a long hiatus due to professional reasons I am back... and in force I hope. I also endured a little surgery not too long ago, but this has also passed by. The reasons are not to be alarming but nonetheless I will still have to undergo surgery one more time in a couple months but then all is set.

There is so much to talk about that I don't even know where to start. The markets in terms of the stock markets have been pretty much range bound since the last time I posted. But in the commodities arena... my oh my... there are some beauties out there... but also don't forget that beauties can turn into ugly monsters in a matter of an instant at times.

One of those beauties is SILVER.

Silver has exploded up high for the past few weeks, and lucky me I was on board for most part of when the breakout took place. But it bothers me... the pace of the rise has been pretty much parabolic and sentiment among traders in silver is sky high at 98% !! This means only 2% believe silver will go down in the future...

You, as long time readers of myBullmarket, know that when the majority is on the wagon it's usually when this one derails off course.

Silver looks to be such case... in a blow off top manner, these type of movements end in only one way, the spectacular rise gives turn to a spectacular downfall as well...

I know I know... "Oh but the FED is printing billions after billions... silver will go through the roof with so much printing". While the FED may be printing like there's no tomorrow, I'm a firm believer that markets ultimately will go wherever they want to, with FED or no FED... remember last year when everyone was advocating the downfall of the Dollar for the same reasons? "Hyperinflation this, hyperinflation that...." What happened? The dollar rallied from 74 up 'til 89 in the subsequent months, and here at myBullmarket we anticipated that move.

6 months later and with EURUSD in the crapper myBullmarket made use of the "Magazine Cover" curse, when magazine The Economist had in their cover the enterings of Leninegrad making allusion of the downfall of the Euro, and we anticipated a move upwards in the Euro for a few months. It has been 4-5 months since then, and with the Euro now at 1.40's I think we have the same type of contrarian signal once again...

The Euro looks poised to start a decline for the weeks to come and silver in my opinion... well a picture is worth a 1000 words they say...

See how the move looks parabolic? Like I said these type of moves that are spectacular in a way turn out to reverse and do it so in a spectacular fashion as well...

In the graph above we have silves again ... we may have some more room to the upside... there is strong resistance at the top of the channel around 30 USD per ounce and that may well be the point where silver reverses and starts a meaningful or a very nasty decline. Also 30 USD is also the target from the inverted H&S formation that went from 2008-2010, so we have 2 points of confluence in resistance...

Therefore I'm starting to be itchy with my position in silver and will start to scale down along the way up but always leaving a few so if a stronger trend happens to take place I will take advantage of it... but I doubt it. Although trends usually do go way beyond of what most people anticipate...

------------------------------------------------------------------------------

Disclaimer: The author holds long positions in Silver and long positions in EURUSD. The author does not take responsibility from the actions taken by others. The opinions listed on this article are of the author only, and shall not be deemed as financial advice, or any other sort of advice. All visitors to the blog should do their own research before making any decisions. This blog, its affiliates, partners or authors are not responsible or liable for any misstatements and/or losses any one might sustain from the content provided. Author is not a registered financial advisor. Author does not engage in dispensing financial advice.

Thursday, July 1, 2010

House numbers

Today the house numbers were really really bad: -30% which was a number 3 times higher than what it was expected.

This is what I've warned before and before, without the FED intervening the market just collapses. We've seen good numbers for the past 12 months, exclusively due to the programs that the FED implemented throughout the country in order to hold the prices. So, once they ended the programs back in April, we now see these numbers !

Now what will they do? Let the market function properly or intervene once more ? If they do, where will they get the money? Print it? They can't hold the prices forever... either it breaks, or they will have to print themselves out of this mess, and then face freakin' super inflation. No matter what the step is, it leads to a crisis either deflation or superinflation...

Again, the crisis is en route !

P.S - Today was another good day for the portfolio ! Despite of the decline of the markets of -0.5% and in the middle of the day the markets even got to -1.7%, the portfolio ended the day in the green at a variation of +0.53% ...

Let's hope it keeps this way on the down days ;)

A few stats:

+47.16% return since inception (dividends not included)

+24.52% annual return (dividends not included)

Portfolio vs. Market = +60.54% (dividends not included) - our overperformance from yesterday increased from the high 59.xx%'s to 60.54% an increase of almost 1% which is great !!

Market Return since inception of Portfolio: -13.38% (dividends not included)

June Market Return: -6.1%

June LMP Return: +2.02%

What does this mean? Translating it, it means that yes our stocks as a whole went declined as well, but they declined only -4.08% while the market declined more than 6%, and since we are short the market, thus the difference is our gain.

This is what I've warned before and before, without the FED intervening the market just collapses. We've seen good numbers for the past 12 months, exclusively due to the programs that the FED implemented throughout the country in order to hold the prices. So, once they ended the programs back in April, we now see these numbers !

Now what will they do? Let the market function properly or intervene once more ? If they do, where will they get the money? Print it? They can't hold the prices forever... either it breaks, or they will have to print themselves out of this mess, and then face freakin' super inflation. No matter what the step is, it leads to a crisis either deflation or superinflation...

Again, the crisis is en route !

P.S - Today was another good day for the portfolio ! Despite of the decline of the markets of -0.5% and in the middle of the day the markets even got to -1.7%, the portfolio ended the day in the green at a variation of +0.53% ...

Let's hope it keeps this way on the down days ;)

A few stats:

+47.16% return since inception (dividends not included)

+24.52% annual return (dividends not included)

Portfolio vs. Market = +60.54% (dividends not included) - our overperformance from yesterday increased from the high 59.xx%'s to 60.54% an increase of almost 1% which is great !!

Market Return since inception of Portfolio: -13.38% (dividends not included)

June Market Return: -6.1%

June LMP Return: +2.02%

What does this mean? Translating it, it means that yes our stocks as a whole went declined as well, but they declined only -4.08% while the market declined more than 6%, and since we are short the market, thus the difference is our gain.

Thursday, May 6, 2010

Euro and Market Psychology

A little update in the €uro, now that we're almost reaching our target, I think it's appropriate to make an update.

For the past 6 months, the EUR/USD has been declining relentlessly from 1.50 to around 1.28. It was such a nice move. Trendy, with not many retraces, etc.

All in all, a 2200 pip move, which I hope most of you were able to grab. Now what for the EURUSD?

Well, here's a graph updated with EW labels and my expectations to the mid-term future:

As you can see, the structure is beautifully textbook: 5 waves down, with what appears to be an extended 5th.

In terms of psychology, it is behaving just as predicted, and here EW can be of help too. Let me quote Robert Prechter in EWP and wave personalities:

The quotes are of course under a bullish view, so you just have to switch the adjectives to the opposite side, so instead of saying "increasingly favorable (....) as confidence returns" we would say "increasingly unfavourable as fear returns". The same for the fifth wave.

So let's take this into what happened since the high. We have the wave (3) in red which as we can see was the strongest part of the move in terms of breadth, and where fundamentals started to deteriorate, as also at that time the trend was unmistakable.

Then, it came wave (5), which is the current wave we are, although it's almost finished. Again, during 5th waves PESSIMIS runs extremely high despite narrowing of breadth. This is the time, where the public acknowledges what is going on. Fundamentals are at its' worst, and the euro is on the spotlight on the media, etc.

What has been going on since wave 5 on media? We now see inumerous economists calling for the end of the €uro, fundamentals are at its' worst with Greece pretty much in ruin. Portugal is pretty much going through the same path as well, although not as bad as Greece... yet.

Newspapers, and not only the financial ones, give notoriety to doom and gloomers and other financial talkheads at this point, everyone is now calling for the end of Europe and Greece and €uro currency, riots and manifestations in Greece, talk about ultimate pessimism...

For the past 2-3 weeks all I've been seeing on TV, and other types of media is everyone so bearish on Euro right now. Today, when reading a newspaper, 10 economists were calling for the end of the Euro. Tell me about pessimism...

I only ask: Where were the talking heads calling for the end of € when it was trading at 1.50 ? At that time, of course optimism reigned. We were as well in a fifth wave, but on the opposite side (bullish) so everyone was optimistic on the €. I saw people calling for values of 2.00 for the EUR/USD.

So what to expect now that pessimism took over pretty much everyone? It's time for the market to do the exact opposite thing.

I think, we are still missing one more down wave, as in the graph I posted, to conclude the wave structure. This may take us to the 1.25 level which is a strong support. Nevertheless, my view is the next big move will be to the upside, not the downside.

As for a target on the upside, well since it will be a corrective wave, the structure is a lot more difficult to predict, but the target box is a good figure of the target, especially the mid-line of the box around the 1.390ish area.

At the middle of wave [2] of course, fundamentals will stop deteriorating or at least will have that appearance. The Euro may lose the spotlight for a bit, when people will think the worst is now over...

Again quoting Robert Prechter on waves personalities (again this is under a bullish view so you have to switch the adjectives around... since waves 2 under a bullish view is a down wave, the adjectives are negative in here... so under a bearish view a wave 2 will have positive characteristics in terms of psychology):

For the past 6 months, the EUR/USD has been declining relentlessly from 1.50 to around 1.28. It was such a nice move. Trendy, with not many retraces, etc.

All in all, a 2200 pip move, which I hope most of you were able to grab. Now what for the EURUSD?

Well, here's a graph updated with EW labels and my expectations to the mid-term future:

As you can see, the structure is beautifully textbook: 5 waves down, with what appears to be an extended 5th.

In terms of psychology, it is behaving just as predicted, and here EW can be of help too. Let me quote Robert Prechter in EWP and wave personalities:

Third Waves - Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. Increasingly favorable fundamentals enter the picture as confidence returns.[...] Strength. Breadth. Best fundamentals. Increasing real prosperity. By the end, the underlying trend is considered up.

Fifth Waves - Fifth waves are always less dynamic than third waves in terms of breadth. They usually display slower maximum speed of price change as well, although if a fifth wave is an extension, speed of price change in the third of the fifth can exceed that of the third wave. (...) Even if a fifth wave extends, the fifth of the fifth will lack the dynamism that preceded it. During advancing fifth waves, optimism runs extremely high despite narrowing of breadth. Market performance and fundamentals improve, but not to levels of wave 3. Psychology creates overvaluation

The quotes are of course under a bullish view, so you just have to switch the adjectives to the opposite side, so instead of saying "increasingly favorable (....) as confidence returns" we would say "increasingly unfavourable as fear returns". The same for the fifth wave.

So let's take this into what happened since the high. We have the wave (3) in red which as we can see was the strongest part of the move in terms of breadth, and where fundamentals started to deteriorate, as also at that time the trend was unmistakable.

Then, it came wave (5), which is the current wave we are, although it's almost finished. Again, during 5th waves PESSIMIS runs extremely high despite narrowing of breadth. This is the time, where the public acknowledges what is going on. Fundamentals are at its' worst, and the euro is on the spotlight on the media, etc.

What has been going on since wave 5 on media? We now see inumerous economists calling for the end of the €uro, fundamentals are at its' worst with Greece pretty much in ruin. Portugal is pretty much going through the same path as well, although not as bad as Greece... yet.

Newspapers, and not only the financial ones, give notoriety to doom and gloomers and other financial talkheads at this point, everyone is now calling for the end of Europe and Greece and €uro currency, riots and manifestations in Greece, talk about ultimate pessimism...

For the past 2-3 weeks all I've been seeing on TV, and other types of media is everyone so bearish on Euro right now. Today, when reading a newspaper, 10 economists were calling for the end of the Euro. Tell me about pessimism...

I only ask: Where were the talking heads calling for the end of € when it was trading at 1.50 ? At that time, of course optimism reigned. We were as well in a fifth wave, but on the opposite side (bullish) so everyone was optimistic on the €. I saw people calling for values of 2.00 for the EUR/USD.

So what to expect now that pessimism took over pretty much everyone? It's time for the market to do the exact opposite thing.

I think, we are still missing one more down wave, as in the graph I posted, to conclude the wave structure. This may take us to the 1.25 level which is a strong support. Nevertheless, my view is the next big move will be to the upside, not the downside.

As for a target on the upside, well since it will be a corrective wave, the structure is a lot more difficult to predict, but the target box is a good figure of the target, especially the mid-line of the box around the 1.390ish area.

At the middle of wave [2] of course, fundamentals will stop deteriorating or at least will have that appearance. The Euro may lose the spotlight for a bit, when people will think the worst is now over...

Again quoting Robert Prechter on waves personalities (again this is under a bullish view so you have to switch the adjectives around... since waves 2 under a bullish view is a down wave, the adjectives are negative in here... so under a bearish view a wave 2 will have positive characteristics in terms of psychology):

Second waves often retrace so much of wave one that most of the profits gained up to that time are eroded away. This is especially true of call option purchases, as premiums sink drastically in the environment of fear during second waves. At this point, investors are thoroughly convinced that the bear market is back to stay. Fundamental conditions often as bad as or worse than those at the previous bottom. Underlying trend considered down. Does not carry to new low.But once this wave [2] is over, wave [3] will begin...and at that time the downtrend will be unmistakable to anyone and the crisis will be already deep ingrained...

Tuesday, May 4, 2010

Music on loop...

After a short-selling ban from the Greek government last week, we knew what would happen. We know better, and it seems the politicians can't figure it out themselves. I really don't know who teaches economics and other things to them.

So, history doesn't repeat, but it often rhymes. Well, just like any other time, when the government banned shorts, this measures had done nothing to prevent the declines...

I bet the greek politicians are scratching their heads right now:

Today the Greek stock market fell -7% ... seriously when will these guys learn a thing or two?

But no problem, we rather use the government's decisions as contrarian signals ... :

So, history doesn't repeat, but it often rhymes. Well, just like any other time, when the government banned shorts, this measures had done nothing to prevent the declines...

I bet the greek politicians are scratching their heads right now:

Ok we can't blame the short sellers now, who should we blame then? Easter bunny perhaps?

Today the Greek stock market fell -7% ... seriously when will these guys learn a thing or two?

But no problem, we rather use the government's decisions as contrarian signals ... :

Tuesday, April 27, 2010

Πορτογαλία

The title is not a mistake.

It stands for "Portugal" in Greek. Yup that's right. Portuguese debt was today downgraded 2 ratings by S&P, and few minutes after, S&P cut Greece's bonds to JUNK bonds (a ratting lower than BBB-).

I keep saying over and over again, that Portugal is at the brink of collapse. Our ignorant governants of course all they do is blame the evil speculators, instead of doing their job, which is to balance the freaking finances.

PSI-20 today crashed -5.4%, while Greece declined 7/8% if I am not mistaken...

This was last night's graph of the Portuguese index:

I said yesterday, there was no freakin' reason to want to be invested in PSI-20, and I guess it was for a good reason. Today we closed at around 7,000 points, which pretty much is the bottom of the previous graph...

As for Greece, remember the graph I posted last week with a Head and Shoulders pattern... now the index stands like this:

I will say it again, don't try to catch a falling knife...

Είμαστε πατήσαμε (We are fu----)

It stands for "Portugal" in Greek. Yup that's right. Portuguese debt was today downgraded 2 ratings by S&P, and few minutes after, S&P cut Greece's bonds to JUNK bonds (a ratting lower than BBB-).

I keep saying over and over again, that Portugal is at the brink of collapse. Our ignorant governants of course all they do is blame the evil speculators, instead of doing their job, which is to balance the freaking finances.

PSI-20 today crashed -5.4%, while Greece declined 7/8% if I am not mistaken...

This was last night's graph of the Portuguese index:

I said yesterday, there was no freakin' reason to want to be invested in PSI-20, and I guess it was for a good reason. Today we closed at around 7,000 points, which pretty much is the bottom of the previous graph...

As for Greece, remember the graph I posted last week with a Head and Shoulders pattern... now the index stands like this:

I will say it again, don't try to catch a falling knife...

Είμαστε πατήσαμε (We are fu----)

Monday, April 26, 2010

Up up away...

After last week, when Greece activated financial help, bonds decreased from 8.8% yield to low 8% which is huge move.

It was to be expected of course. The same way it was to be expected that in the bigger picture that would have NO IMPACT at all. After that decline, the trend just resumed and the 10 Year Bonds are now trading at 9.4% while the 2 Year Bonds at 13%...

Today's Greek bond chart.

The Euro on the other hand, pretty much since we at this website advocated for a large move on the dollar, it has gone down from 1.50'ish and is now trading in the low 1.30'ish.

We're on our way for the Euro to trade below 2008 level of 1.23'ish.

It was to be expected of course. The same way it was to be expected that in the bigger picture that would have NO IMPACT at all. After that decline, the trend just resumed and the 10 Year Bonds are now trading at 9.4% while the 2 Year Bonds at 13%...

Today's Greek bond chart.

The Euro on the other hand, pretty much since we at this website advocated for a large move on the dollar, it has gone down from 1.50'ish and is now trading in the low 1.30'ish.

We're on our way for the Euro to trade below 2008 level of 1.23'ish.

Tuesday, April 6, 2010

Parity and Apple Daziness

Well it seems the loonie has reached parity today. Incredible. 1 canadian dollar is now worth... well... 1 american dollar.

The Canadian dollar is actually on of the few currencies worldwide to have strengthen lately, since the dollar has been in a rally mode pretty much since November/December.

But take a closer look though. If I would care to take a guess, I'd say the bearishness on this pair is about to end with what seems 5 waves already on this last down move. From there on, it is my opinion that the USD will start to strengthen just as much as it has been happening with other currencies. USDCAD may be a little late for the party, but is sure to make a great entrance I bet.

Apple launched yesterday their iPad, which is full of hype. Just another fancy product that lacks in quality and utility.

If you're one to believe in mass media psychology maybe Apple is reaching it's pinnacle.

The cover of TIMES magazine serves very well for contrarian signals, once a subject makes the cover it usually means it's the pinnacle of that subject.

Hitler made cover in 1939, and Estaline also made cover before his demise.

In 1999 the cover featured Jeff Bezos, Amazon's CEO which was the exact top both for the stock and internet bubble.

2005 the cover was the real estate investor, and we all know how that ended.

After last year's Fall covering Ben Bernanke which I believe to be also his pinnacle, this month's cover:

Saturday, March 27, 2010

Big Update

Hello Hello fellas...

It's been a long time since a proper update on the blog, but it has been very hard to keep up with everything going on. Today I will make a proper update starting from our little portfolio which we can say is in good health, to currencies, stock market, commodities and what can we expect from here on.

So let's start with our portfolio:

This one looks to be a very hard task, I have a few ideas on my mind and some of our current positions appear in the screener once again, so it will be more cumbersome to me, since I had to go through their graphs to see which ones could offer more potential. The fact that the market is deeply overbought makes the timing of our purchase to be very poor. I will present some facts further down the road, to see if we press the trigger on Monday or not.

Here is the current state of the portfolio:

Well the stocks that are up for a switch and their respective returns since we've bought them are the following:

- IPHS +141%

- NOV +19%

- DIVX +45%

- COH +134%

- MOS +29%

- DELL +45%

So, these stocks have served us well especially IPHS and COH, but it will be time to sell them now except for Coach (COH). This one I still like it.

The new contenders for the next year should be:

- WTW

- APOL

- FWLT

- SOLR

- SOHU

- COH (which we already have in the portfolio).

Now the thing is, the first group of stocks are to be sold at the opening of Monday. I will not buy the the new contenders right away and why is that?

Because the market is extremely overbought and in my opinion a correction is due next week at least, so I will be waiting a bit to see if the market drops. In terms of S&P the readings are in the extremes, and nothing goes up in a straight manner of course.

Here is a signal that has served well in the past months and is now triggering a potential top:

Every time the conditions on volatility crossed over its' MA it was a top before a mild or even a stronger correction.

Regarding the Dollar, everything is going acording to plan. The dollar has been rising relentlessly against pretty much every currency. The scenario I traced out almost a year ago has been such a very good road map for us:

Now, the thing is, I see this rally hitting a mid-term top. I can already count 5 waves up of the same degree so it may be time for a little bit of a rest on the Dollar. As you can see the EW structure since the bottom is textbook clear:

The same goes for Eurodollar, which pretty much is the Dollar Index chart but inverted:

The idea to remain is the trend is clearly down for Euro and other currencies against the dollar. The pundits that keep saying how the dollar is doomed i bet they are scratching their heads, and of course they are blaming this due to Greece problems. The fact is the one who makes the news is the market, not the other way around. I didn't even dream of bailouts, IMF's, PIGS and Greece almost a year ago, and yet the dollar is behaving pretty much the way i said it to be in terms of structure, price action, etc... of course they will keep putting the blame into Greece, etc. We of course know better :-)

This chart if I remember correctly was made in July 2009. The green up arrow is the red (1) wave from the updated dollar index chart. As for very long-term we still can't know for sure if this is a rally just to test the 100 area or if it is a new bull long term bull market. As time goes by, we should know that more along the way as we get closer to the inflection points:

This is all for now. Tomorrow will be sky diving day :-D

So if you hear nothing from me the next week or so, it's because my parachute didn't open.

It's been a long time since a proper update on the blog, but it has been very hard to keep up with everything going on. Today I will make a proper update starting from our little portfolio which we can say is in good health, to currencies, stock market, commodities and what can we expect from here on.

So let's start with our portfolio:

This one looks to be a very hard task, I have a few ideas on my mind and some of our current positions appear in the screener once again, so it will be more cumbersome to me, since I had to go through their graphs to see which ones could offer more potential. The fact that the market is deeply overbought makes the timing of our purchase to be very poor. I will present some facts further down the road, to see if we press the trigger on Monday or not.

Here is the current state of the portfolio:

Well the stocks that are up for a switch and their respective returns since we've bought them are the following:

- IPHS +141%

- NOV +19%

- DIVX +45%

- COH +134%

- MOS +29%

- DELL +45%

So, these stocks have served us well especially IPHS and COH, but it will be time to sell them now except for Coach (COH). This one I still like it.

The new contenders for the next year should be:

- WTW

- APOL

- FWLT

- SOLR

- SOHU

- COH (which we already have in the portfolio).

Now the thing is, the first group of stocks are to be sold at the opening of Monday. I will not buy the the new contenders right away and why is that?

Because the market is extremely overbought and in my opinion a correction is due next week at least, so I will be waiting a bit to see if the market drops. In terms of S&P the readings are in the extremes, and nothing goes up in a straight manner of course.

Here is a signal that has served well in the past months and is now triggering a potential top:

Every time the conditions on volatility crossed over its' MA it was a top before a mild or even a stronger correction.

Regarding the Dollar, everything is going acording to plan. The dollar has been rising relentlessly against pretty much every currency. The scenario I traced out almost a year ago has been such a very good road map for us:

Now, the thing is, I see this rally hitting a mid-term top. I can already count 5 waves up of the same degree so it may be time for a little bit of a rest on the Dollar. As you can see the EW structure since the bottom is textbook clear:

The same goes for Eurodollar, which pretty much is the Dollar Index chart but inverted:

The idea to remain is the trend is clearly down for Euro and other currencies against the dollar. The pundits that keep saying how the dollar is doomed i bet they are scratching their heads, and of course they are blaming this due to Greece problems. The fact is the one who makes the news is the market, not the other way around. I didn't even dream of bailouts, IMF's, PIGS and Greece almost a year ago, and yet the dollar is behaving pretty much the way i said it to be in terms of structure, price action, etc... of course they will keep putting the blame into Greece, etc. We of course know better :-)

This chart if I remember correctly was made in July 2009. The green up arrow is the red (1) wave from the updated dollar index chart. As for very long-term we still can't know for sure if this is a rally just to test the 100 area or if it is a new bull long term bull market. As time goes by, we should know that more along the way as we get closer to the inflection points:

This is all for now. Tomorrow will be sky diving day :-D

So if you hear nothing from me the next week or so, it's because my parachute didn't open.

Sunday, February 28, 2010

February Performance and review

With February behind our back, the performance on my trading was a bit disappointing. Not because of the numbers per se but due to my execution. I made too many errors on my trading this month and it cost me the difference of either being profitable or not.

On a mark-to-market basis, the account closed -3.2% for the month. I estimate my mistakes to have cost me around 10-15% which if I hadn't made them I would've end up deep in the green for the month. Mistakes were attributed to poor execution of my part, and one of them that cost me a loss of 3R (so the loss was 200% bigger than what I was willing to lose) was due to a price movement where it went well above my exit point, in which I forgot to put a stop in place.

Another mistakes were that at particular times on a few trades I got a bit biased. Especially in the currency market, where as all of you know I've been incredibly bullish for the dollar for quite sometime, so I underexposed myself on some trading signals just because they were against my bullish view of the dollar. Just because my system as telling me to go short dollar, because my bias was bullish I cut my risk to half, which is a mistake, since it was a decision based on my bias.

For this month, execution has to be key ! And later in the month we'll also have again a new shopping spree for our LMP portfolio. The portfolio is still beating the crap out of S&P, although as expected has been down as a whole since the peak of the market in January. We'll see how the month goes, and my bias tells me that in 4 weeks or so, we'll be a lot lower on the markets. This week should be the starting point of one severe downturn in my opinion. Indexes are at the brink of a new decline from the looks of it, which if confirmed, should take the S&P towards the 993-1000 points level.

On a mark-to-market basis, the account closed -3.2% for the month. I estimate my mistakes to have cost me around 10-15% which if I hadn't made them I would've end up deep in the green for the month. Mistakes were attributed to poor execution of my part, and one of them that cost me a loss of 3R (so the loss was 200% bigger than what I was willing to lose) was due to a price movement where it went well above my exit point, in which I forgot to put a stop in place.

Another mistakes were that at particular times on a few trades I got a bit biased. Especially in the currency market, where as all of you know I've been incredibly bullish for the dollar for quite sometime, so I underexposed myself on some trading signals just because they were against my bullish view of the dollar. Just because my system as telling me to go short dollar, because my bias was bullish I cut my risk to half, which is a mistake, since it was a decision based on my bias.

For this month, execution has to be key ! And later in the month we'll also have again a new shopping spree for our LMP portfolio. The portfolio is still beating the crap out of S&P, although as expected has been down as a whole since the peak of the market in January. We'll see how the month goes, and my bias tells me that in 4 weeks or so, we'll be a lot lower on the markets. This week should be the starting point of one severe downturn in my opinion. Indexes are at the brink of a new decline from the looks of it, which if confirmed, should take the S&P towards the 993-1000 points level.

Wednesday, February 24, 2010

The Jaguars and Deflation

I hear every time, that the Fed control's whatever it wants and that itself would avoid any deflationary scenario.

I disagree. The Fed controls nothing. It is subject to social mood forces, and their actions are the reflection of the current mood of the public. It's a cause-reaction kind of thing.

For you to understand more how could deflation prevail even with the Fed as the main character and Bernanke as the star, here's a nice little explanation that EWI put up a very long time ago and it has resurfaced again:

I disagree. The Fed controls nothing. It is subject to social mood forces, and their actions are the reflection of the current mood of the public. It's a cause-reaction kind of thing.

For you to understand more how could deflation prevail even with the Fed as the main character and Bernanke as the star, here's a nice little explanation that EWI put up a very long time ago and it has resurfaced again:

"The Fed Will Stop Deflation"

I am tired of hearing people insist that the Fed can expand credit all it wants. Sometimes an analogy clarifies a subject, so let’s try one.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing Jaguar automobiles and providing them to as many people as possible. To facilitate that goal, it begins operating Jaguar plants all over the country, subsidizing production with tax money. To everyone’s delight, it offers these luxury cars for sale at 50 percent off the old price. People flock to the showrooms and buy. Later, sales slow down, so the government cuts the price in half again. More people rush in and buy. Sales again slow, so it lowers the price to $900 each. People return to the stores to buy two or three, or half a dozen. Why not? Look how cheap they are! Buyers give Jaguars to their kids and park an extra one on the lawn. Finally, the country is awash in Jaguars. Alas, sales slow again, and the government panics. It must move more Jaguars, or, according to its theory -- ironically now made fact -- the economy will recede. People are working three days a week just to pay their taxes so the government can keep producing more Jaguars. If Jaguars stop moving, the economy will stop. So the government begins giving Jaguars away. A few more cars move out of the showrooms, but then it ends. Nobody wants any more Jaguars. They don’t care if they’re free. They can’t find a use for them. Production of Jaguars ceases. It takes years to work through the overhanging supply of Jaguars. Tax collections collapse, the factories close, and unemployment soars. The economy is wrecked. People can’t afford to buy gasoline, so many of the Jaguars rust away to worthlessness. The number of Jaguars -- at best -- returns to the level it was before the program began.

The same thing can happen with credit.

It may sound crazy, but suppose the government were to decide that the health of the nation depends upon producing credit and providing it to as many people as possible. To facilitate that goal, it begins operating credit-production plants all over the country, called Federal Reserve Banks. To everyone’s delight, these banks offer the credit for sale at below market rates. People flock to the banks and buy. Later, sales slow down, so the banks cut the price again. More people rush in and buy. Sales again slow, so they lower the price to one percent. People return to the banks to buy even more credit. Why not? Look how cheap it is! Borrowers use credit to buy houses, boats and an extra Jaguar to park out on the lawn. Finally, the country is awash in credit. Alas, sales slow again, and the banks panic. They must move more credit, or, according to its theory -- ironically now made fact -- the economy will recede. People are working three days a week just to pay the interest on their debt to the banks so the banks can keep offering more credit. If credit stops moving, the economy will stop. So the banks begin giving credit away, at zero percent interest. A few more loans move through the tellers’ windows, but then it ends. Nobody wants any more credit. They don’t care if it’s free. They can’t find a use for it. Production of credit ceases. It takes years to work through the overhanging supply of credit. Interest payments collapse, banks close, and unemployment soars. The economy is wrecked. People can’t afford to pay interest on their debts, so many bonds deteriorate to worthlessness. The value of credit -- at best -- returns to the level it was before the program began.

Jaguars, anyone?

Friday, February 12, 2010

Tiny update

Not much has been going on the markets lately... it's been boring with this sort of sideways/consolidation range.

There are a few alternatives on the table that I think may be going on. Either this wave down is subdividing and we are up for a few fireworks next week, or the bounce still has some more powder left.

We have to let the market show us the path, there are times where the patterns are clear as water and we have to take action in order to take advantage of them, there are others where it's a bit fuzzy of where we are in the general scheme. These are when we should be out, waiting for the market to clear itself.

As for the US Dollar, the trend remains clearly up. Wave 3 is subdividing so I think we still have some more upside to go before a more meaningful correction, although corrections can be pretty shallow. Remember what I've said, when the larger degree trend is up, surprises happen to the upside, so, our goal is to spot bottoms not tops.

The major signals of Zé Manel on the daily, remain the same. Trend is down. Of course it can always change, but so far my bet is on the short side.

We'll see how next week develops, and I am eager to see how it will fold out

There are a few alternatives on the table that I think may be going on. Either this wave down is subdividing and we are up for a few fireworks next week, or the bounce still has some more powder left.

We have to let the market show us the path, there are times where the patterns are clear as water and we have to take action in order to take advantage of them, there are others where it's a bit fuzzy of where we are in the general scheme. These are when we should be out, waiting for the market to clear itself.

As for the US Dollar, the trend remains clearly up. Wave 3 is subdividing so I think we still have some more upside to go before a more meaningful correction, although corrections can be pretty shallow. Remember what I've said, when the larger degree trend is up, surprises happen to the upside, so, our goal is to spot bottoms not tops.

The major signals of Zé Manel on the daily, remain the same. Trend is down. Of course it can always change, but so far my bet is on the short side.

We'll see how next week develops, and I am eager to see how it will fold out

Monday, February 8, 2010

Was that the correction?

My beloved readers (both of you lol) I think we can pretty much say the trend is down, until proven otherwise.

We are on the verge of what can be a 3rd of a 3rd wave down. If you don't know what a 3rd of a 3rd wave down is, it is the most powerful place of a certain degree of trend. In this case, what I thought it could be the start of a bigger bounce on Friday may as well be all that is of the bounce. That's why the main purpose is to grab the tops and not finding the bottoms right now, because waves can always extend and rallies be very brief.

Today it marked the largest downside Advance/Decline ratio. If this were to be a 5th wave, we shouldn't have a bigger number than the one we had seen last week, but we did, hence adding more support to the 3rd of the 3rd scenario right now.

As I said a couple weeks ago, a trip to 1000-1013 points would be in the cards in a very fast manner in case of a 3rd wave, and it seems that's what may be in the cards.

The US Dollar remains the same. It's been overbought for weeks now, but I've been warning also for weeks, that the trend was up so buying every dip was the best bet and our focus was to find bottoms not tops since it could always extend and we didn't want to miss the ride up.

Do not forget when we are at a larger degree of trend, as it is the case now for USD clearly, in an uptrend surprises always happen to the upside and corrections may be very shallow and brief. That's what happened in 2008 and what appears to be happening now. We already surpassed the 80 pts in the index, and at this pace we may well reach the 90 points in a few months. That would put EURUSD at or below 1.25.

So let's keep an eye on it, and if we do get a bounce, in my opinion will be a gift of gods and I will surely be shorting it, but the market has it's tricks and as we know it likes to issue the least possible tickets for the ride - and a lot of bears would be missing the boat since most or many bears enter on short positions at bounces or retraces...

Me ? I don't care, I'm mostly a breakout kind of guys, if it shows weakness we should short since we can never know how big of a retracement it could happen or if it happens at all... food for thought everybody.

I am sorry for the lack of graphs on today's post. I will surely compensate by tomorrow with a more thorough post.

We are on the verge of what can be a 3rd of a 3rd wave down. If you don't know what a 3rd of a 3rd wave down is, it is the most powerful place of a certain degree of trend. In this case, what I thought it could be the start of a bigger bounce on Friday may as well be all that is of the bounce. That's why the main purpose is to grab the tops and not finding the bottoms right now, because waves can always extend and rallies be very brief.

Today it marked the largest downside Advance/Decline ratio. If this were to be a 5th wave, we shouldn't have a bigger number than the one we had seen last week, but we did, hence adding more support to the 3rd of the 3rd scenario right now.

As I said a couple weeks ago, a trip to 1000-1013 points would be in the cards in a very fast manner in case of a 3rd wave, and it seems that's what may be in the cards.

The US Dollar remains the same. It's been overbought for weeks now, but I've been warning also for weeks, that the trend was up so buying every dip was the best bet and our focus was to find bottoms not tops since it could always extend and we didn't want to miss the ride up.

Do not forget when we are at a larger degree of trend, as it is the case now for USD clearly, in an uptrend surprises always happen to the upside and corrections may be very shallow and brief. That's what happened in 2008 and what appears to be happening now. We already surpassed the 80 pts in the index, and at this pace we may well reach the 90 points in a few months. That would put EURUSD at or below 1.25.

So let's keep an eye on it, and if we do get a bounce, in my opinion will be a gift of gods and I will surely be shorting it, but the market has it's tricks and as we know it likes to issue the least possible tickets for the ride - and a lot of bears would be missing the boat since most or many bears enter on short positions at bounces or retraces...

Me ? I don't care, I'm mostly a breakout kind of guys, if it shows weakness we should short since we can never know how big of a retracement it could happen or if it happens at all... food for thought everybody.

I am sorry for the lack of graphs on today's post. I will surely compensate by tomorrow with a more thorough post.

Monday, February 1, 2010

Double trouble

January ended in the negative. Things don't look pretty no. There is a saying based in a pattern that says: "So goes January, so goes the year".

In fact this is true, since 1951 which is the maximum my database gets, when January was a down month either of 3 things happened:

- Flat year

- Correction bigger than 10%

- Bear market or resume of bear market.

This is true for almost 60 years which is rather amazing. So statistically speaking the maximum potential would be a flat year. My perspective as many of you know is inclined for the 3rd option. I have for long shouted out loud, that we are in a bear market rally and so far everything points to that.

Economically speaking, nothing has improved other than the usual "it stopped falling as hard the macro indicators, etc etc".

As we've seen lately with the Greece news, the markets are rather nervous. Deficits are sky high and sovereign debt costs in PIIGS countries are sky rocketing. For Greece, investors almost are counting on a default.

10 year bonds were 4+% in December... they are now 7.4% ! This is a parabolic move and something must be going on the background for this to happen... If Greece goes under I have no doubt other countries will follow suit... especially my poor little Portugal, unfortunately.

The trend according to Zé Manuel has changed in several indices. SP500 is one among them... the same for PSI-20, the home index of your fellow blogger.

I have no access to them right now but will post them later during the day.

As for our friends at EWI they have been very bearish as well, and I believe they are in the correct path and that we are in a deflationary period. All indicates to that so far...

Here's a graph from the Money Supply Aggregate and how ferociously the contraction of the monetary aggregate has been for the past 1-2 years

What about the unemployment in USA? Their policy has been to launch fuzzy numbers to the public, especially when people compare today's values to the Great Depression they don't know they're comparing different values !! Remember that comedic video I posted about the unemployment, the contest video?

We are approaching dangerously to the same figures as happened during the 30's.

That figure during the 30's was around 22-24%. We currently are under the 17.5% area.

As a final note, you know I'm not a person to advertise much. I could fill this site with affiliate banners of rather popular robots nowadays of Forex and make a cash load of money on affiliate money alone (some around the 500 USD per product). I don't do that because I don't endorse stuff I don't believe in. EWI is probably one of the few I think has their client's interests at heart. You can subscribe to their Club, which is free and you will have loads of resources, be it economic stuff or technical analysis. Reports or tutorials you name it.

As for their paid services, in my opinion they are top notch. For one reason they were the #1 Market Timer newsletter for the past 2-3 years, but what I like most is their fundamental reasoning and thought out thesis. There isn't a month where I eagerly await for their stuff to come into my mail box. Love reading it, and if you try them out I bet you'll find it worthwhile, especially now where we are at a crucial juncture in my opinion and they may be of help on these unthreaded waters that we're about to cross.

If you do join the EWI club, please do so from my banners... it is a way of you supporting this page. It is free and on their subscriptions it's 100% money back guarantee so there is no risk there. But my guess is you'll think it's worth it.

Click here to receive one of their latest reports regarding the markets for 2010:

Sorry for this blatant kind of "product plug" :-) but I'm being honest on what I said.

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...

In fact this is true, since 1951 which is the maximum my database gets, when January was a down month either of 3 things happened:

- Flat year

- Correction bigger than 10%

- Bear market or resume of bear market.

This is true for almost 60 years which is rather amazing. So statistically speaking the maximum potential would be a flat year. My perspective as many of you know is inclined for the 3rd option. I have for long shouted out loud, that we are in a bear market rally and so far everything points to that.

Economically speaking, nothing has improved other than the usual "it stopped falling as hard the macro indicators, etc etc".

As we've seen lately with the Greece news, the markets are rather nervous. Deficits are sky high and sovereign debt costs in PIIGS countries are sky rocketing. For Greece, investors almost are counting on a default.

10 year bonds were 4+% in December... they are now 7.4% ! This is a parabolic move and something must be going on the background for this to happen... If Greece goes under I have no doubt other countries will follow suit... especially my poor little Portugal, unfortunately.

I have no access to them right now but will post them later during the day.

As for our friends at EWI they have been very bearish as well, and I believe they are in the correct path and that we are in a deflationary period. All indicates to that so far...

Here's a graph from the Money Supply Aggregate and how ferociously the contraction of the monetary aggregate has been for the past 1-2 years

We are approaching dangerously to the same figures as happened during the 30's.

That figure during the 30's was around 22-24%. We currently are under the 17.5% area.

As a final note, you know I'm not a person to advertise much. I could fill this site with affiliate banners of rather popular robots nowadays of Forex and make a cash load of money on affiliate money alone (some around the 500 USD per product). I don't do that because I don't endorse stuff I don't believe in. EWI is probably one of the few I think has their client's interests at heart. You can subscribe to their Club, which is free and you will have loads of resources, be it economic stuff or technical analysis. Reports or tutorials you name it.

As for their paid services, in my opinion they are top notch. For one reason they were the #1 Market Timer newsletter for the past 2-3 years, but what I like most is their fundamental reasoning and thought out thesis. There isn't a month where I eagerly await for their stuff to come into my mail box. Love reading it, and if you try them out I bet you'll find it worthwhile, especially now where we are at a crucial juncture in my opinion and they may be of help on these unthreaded waters that we're about to cross.

If you do join the EWI club, please do so from my banners... it is a way of you supporting this page. It is free and on their subscriptions it's 100% money back guarantee so there is no risk there. But my guess is you'll think it's worth it.

Click here to receive one of their latest reports regarding the markets for 2010:

Sorry for this blatant kind of "product plug" :-) but I'm being honest on what I said.

As for the markets this week, well, we're deeply oversold and I think a correction of higher degree may happen this week. 1060 on S&P may be a launching point for a rise up to 1100 points maybe... but the goal here from now on is trying to spot the tops and not finding bottoms. Market has changed...

Thursday, January 21, 2010

Bumpy ride

Good morning everyone...

Nothing new in markets paradise...oh wait! Wrong...

The dollar is in such a hurry have you seen the index lately?

It is following the path I projected a couple months ago so nicely... for anyone that wasn't watching let me put you up to date...

I also referred a couple months ago, that I believed the US Dollar to have made the bottom while the indexes needed one additional leg up, just like it happened in 2008 but in reverse (the indexes were in wave 1 down while the currencies were still in the 5th wave up).

The same seems to be happening now... Currencies had their way for wave 1 down, while indexes were on their B wave. The 2nd correction wave on currencies matched with the last C wave up of indexes.

Now it seems currencies are beginning their waves 3 (the most powerful in EW terms) while indexes just started to roll over.

It still needs confirmation and the daily trend is still up, but if this carries for more one or two days the trend will definitely will change even on the dailies.

My opinion this may well be an important top. The first target now is around 1100 points on S&P, and at this pace it seems it will reach it quickly.

EURUSD seems to be in a hurry for 1.37'ish...

Nothing new in markets paradise...oh wait! Wrong...

The dollar is in such a hurry have you seen the index lately?

It is following the path I projected a couple months ago so nicely... for anyone that wasn't watching let me put you up to date...

The same seems to be happening now... Currencies had their way for wave 1 down, while indexes were on their B wave. The 2nd correction wave on currencies matched with the last C wave up of indexes.

Now it seems currencies are beginning their waves 3 (the most powerful in EW terms) while indexes just started to roll over.

It still needs confirmation and the daily trend is still up, but if this carries for more one or two days the trend will definitely will change even on the dailies.

My opinion this may well be an important top. The first target now is around 1100 points on S&P, and at this pace it seems it will reach it quickly.

EURUSD seems to be in a hurry for 1.37'ish...

Sunday, January 17, 2010

Long time no see...

Good weekend everyone...

There have been a lack of posts lately from my part. Today I'm updating a few foreign charts.

Our Sensex from India and introducing the brazilian Bovespa. I'm also very very bullish in this one for a long time. I've said it before that apart from India, I think a few other countries in Southeast Asia are in bull markets in my opinion as well. Those are South Korea and Singapore and also Indonesia, and add that to Brazil.

Brazil actually I believe it's very similar to India. We're in a secular bull market, and this rise is only the start of a Primary 3rd Wave in EW terms. So there's lot of bull market to run in these ones. My opinion is these SECULAR bulls will last around 20 years. Of course we'll have simple bear markets in between, which I've made clear in India for example. I think we'll have a simple Bear Market around the 55,000 level in around 7 years or so. It will be something like this past bear market OR due to the alternation rule in EW terms, some kind of a sideways market (a triangle) very much alike the Dow Jones in the 70's.

But that is still very far away.

My opinion for the last few months was that a top in India was to be reached around the 18,000 level for the end of Wave (1). Indeed it seems to be struggling around that area, and it seems Wave (1) is pretty much finished.

Now the problem is 2nd Waves can retrace deep. I wouldn't be surprised for the coming 2nd Waves in the markets I consider bullish, to be deep, especially considering what I expect from SP500 and other markets. I expect new lows on Western countries' markets, so in this case the scenario could be, all bullish markets to follow SP500 in tandem until a certain point and then diverging.

The bull ones going up, and SP500 and most european countries keep declining.

Still, for long term my bias goes to keep adding capital every month to a fund exposed to these markets (Brazil, India, etc) much alike a passive investing strategy.

As long as these graphs don't show a SELL signal, I wouldn't be worried. If they happen to show a sell signal, I'll issue it here right away, and the prudent thing to do may be to get out. But so far so good, nothing is looking grim on the horizon...

Both trends are up both on Daily and Weekly charts, so we should be good :)

The LMP portfolio is also looking good, and from now on my screeners I will incorporate companies from India and Brazil as long as they also trade in NYSE. We should get a few goodies by incorporating both those markets.

There have been a lack of posts lately from my part. Today I'm updating a few foreign charts.

Our Sensex from India and introducing the brazilian Bovespa. I'm also very very bullish in this one for a long time. I've said it before that apart from India, I think a few other countries in Southeast Asia are in bull markets in my opinion as well. Those are South Korea and Singapore and also Indonesia, and add that to Brazil.

Brazil actually I believe it's very similar to India. We're in a secular bull market, and this rise is only the start of a Primary 3rd Wave in EW terms. So there's lot of bull market to run in these ones. My opinion is these SECULAR bulls will last around 20 years. Of course we'll have simple bear markets in between, which I've made clear in India for example. I think we'll have a simple Bear Market around the 55,000 level in around 7 years or so. It will be something like this past bear market OR due to the alternation rule in EW terms, some kind of a sideways market (a triangle) very much alike the Dow Jones in the 70's.

But that is still very far away.

My opinion for the last few months was that a top in India was to be reached around the 18,000 level for the end of Wave (1). Indeed it seems to be struggling around that area, and it seems Wave (1) is pretty much finished.

Now the problem is 2nd Waves can retrace deep. I wouldn't be surprised for the coming 2nd Waves in the markets I consider bullish, to be deep, especially considering what I expect from SP500 and other markets. I expect new lows on Western countries' markets, so in this case the scenario could be, all bullish markets to follow SP500 in tandem until a certain point and then diverging.

The bull ones going up, and SP500 and most european countries keep declining.

Still, for long term my bias goes to keep adding capital every month to a fund exposed to these markets (Brazil, India, etc) much alike a passive investing strategy.

As long as these graphs don't show a SELL signal, I wouldn't be worried. If they happen to show a sell signal, I'll issue it here right away, and the prudent thing to do may be to get out. But so far so good, nothing is looking grim on the horizon...

Both trends are up both on Daily and Weekly charts, so we should be good :)

The LMP portfolio is also looking good, and from now on my screeners I will incorporate companies from India and Brazil as long as they also trade in NYSE. We should get a few goodies by incorporating both those markets.

Tuesday, December 22, 2009

Brief update...

I won't be much active during the holidays. So to most of you I wish you a Merry Christmas and a happy new year.

Let 2010 be full of happy and good things to all of you.

Anyways, I couldn't help myself to not leave here a brief picture on USD Dollar.

As I warned a few weeks back, the trend has changed. In terms of TA we've got all requisites of a trend change, a trend change that EW was long awaiting around the 74 level as I wrote here back in July.

For those that have a short memory: http://www.mybullmarket.org/2009/07/usd-update.html

;-)

I don't think I got too wrong on it. Let's see how the rest of the prediction rolls out. Which is right here:

I think a strong bear market rally has started for the US Dollar that will drive it up above their 2008 highs or it could be the beginning's of a new bull market. We'll track it along to see what may be in the cards.

Now, a curious fact is USD rocked up, EURUSD plunged everyone awaiting for S&P to plunge AAANND... nothing.

What I've said many times before in here that I was expecting was that Dollar, etc could go in their 1st wave down (EURUSD) or up (dollar index), while the stock indexes remained intact. My view was, these assets (currencies) could lead on the way down on their first waves and then rebound for their Wave 2 correction and stock indexes getting their tops during a lower high in currencies. It's pretty common since no asset has 100% correlation. The same happened in 2008 with oil, indexes and currencies. EURUSD topped when indexes were making their minor wave 2, while Oil topped when indexes were making their intermediate 2.

It would look something like this:

I think I made my point. We'll see what the new year brings. But my opinion it will be what most don't want. I think 2010 will be much more like 2008 than any other year. But that's just me...

Let 2010 be full of happy and good things to all of you.

Anyways, I couldn't help myself to not leave here a brief picture on USD Dollar.

As I warned a few weeks back, the trend has changed. In terms of TA we've got all requisites of a trend change, a trend change that EW was long awaiting around the 74 level as I wrote here back in July.

For those that have a short memory: http://www.mybullmarket.org/2009/07/usd-update.html

;-)

I don't think I got too wrong on it. Let's see how the rest of the prediction rolls out. Which is right here:

I think a strong bear market rally has started for the US Dollar that will drive it up above their 2008 highs or it could be the beginning's of a new bull market. We'll track it along to see what may be in the cards.

Now, a curious fact is USD rocked up, EURUSD plunged everyone awaiting for S&P to plunge AAANND... nothing.

What I've said many times before in here that I was expecting was that Dollar, etc could go in their 1st wave down (EURUSD) or up (dollar index), while the stock indexes remained intact. My view was, these assets (currencies) could lead on the way down on their first waves and then rebound for their Wave 2 correction and stock indexes getting their tops during a lower high in currencies. It's pretty common since no asset has 100% correlation. The same happened in 2008 with oil, indexes and currencies. EURUSD topped when indexes were making their minor wave 2, while Oil topped when indexes were making their intermediate 2.

It would look something like this:

I think I made my point. We'll see what the new year brings. But my opinion it will be what most don't want. I think 2010 will be much more like 2008 than any other year. But that's just me...

Tuesday, December 15, 2009

Very late update...

I apologize for the very late update but I was a bit busy lately so I didn't have much time focusing on doing an appropriate update.

In regards to the indexes, not much has been going on... We've been in this boring range tight market for almost 2 months. What I said before still stands. We should be rolling over soon.

In fact, the dollar seems to have changed to the beginning of an uptrend. This reinforces the possibility of the indexes following suit soon.

EURUSD has definitely changed the trend... in fact wave 5 seems to be extending. Euro may find support in the 1.43xx area.

USD Index seems to have broken out of the downward channel it had been for almost 5 months. It also broke it's Long term trendline. Add this to the fact that the Elliott Wave Structure looks complete now, it has a very high degree of possiblity to begin quite a rally here.

First target will obviously be the 221 MA.

Although USD Index is very correlated to the indexes it doesn't mean they move in exact tandem. In EW terms for example USD Index could now be in the beginning of Wave 1 up, while the indexes (S&P and DOW) are in the midst of the final wave. This happened in 2008 in a lot of assets (ones being already in wave 1 down while others still upward). EURUSD for example should correct soon a bit, this could be a catalyst for new highs on the indexes (for their final wave) while Euro failing to make new highs (which i find very unlikely).

Gold and Silver seem to have started the downward move as well....

To me, this seems to be the long term picture...

EDIT

Also we're almost making changes in our LM Portfolio. Again, if you followed the portfolio, I hope you took my hint of starting the portfolio on November 1st due to seasonality. Long term, it shows that buy ins starting November have a statistical edge over other periods. It may not happen one year or another but long term it seems to be this way, so this was the reason on my own portfolio I did the same as I stated before the September 26th buy in.

This seasonality chart shows the reasoning behind it:

As you can see, most the buy calendar periods fall in either trending up periods or after a big correction (August-October period).

I will go further in detail on this, once we make an update of LM Portfolio

In regards to the indexes, not much has been going on... We've been in this boring range tight market for almost 2 months. What I said before still stands. We should be rolling over soon.

In fact, the dollar seems to have changed to the beginning of an uptrend. This reinforces the possibility of the indexes following suit soon.

EURUSD has definitely changed the trend... in fact wave 5 seems to be extending. Euro may find support in the 1.43xx area.

USD Index seems to have broken out of the downward channel it had been for almost 5 months. It also broke it's Long term trendline. Add this to the fact that the Elliott Wave Structure looks complete now, it has a very high degree of possiblity to begin quite a rally here.

First target will obviously be the 221 MA.

Although USD Index is very correlated to the indexes it doesn't mean they move in exact tandem. In EW terms for example USD Index could now be in the beginning of Wave 1 up, while the indexes (S&P and DOW) are in the midst of the final wave. This happened in 2008 in a lot of assets (ones being already in wave 1 down while others still upward). EURUSD for example should correct soon a bit, this could be a catalyst for new highs on the indexes (for their final wave) while Euro failing to make new highs (which i find very unlikely).

Gold and Silver seem to have started the downward move as well....

To me, this seems to be the long term picture...

EDIT

Also we're almost making changes in our LM Portfolio. Again, if you followed the portfolio, I hope you took my hint of starting the portfolio on November 1st due to seasonality. Long term, it shows that buy ins starting November have a statistical edge over other periods. It may not happen one year or another but long term it seems to be this way, so this was the reason on my own portfolio I did the same as I stated before the September 26th buy in.

This seasonality chart shows the reasoning behind it:

As you can see, most the buy calendar periods fall in either trending up periods or after a big correction (August-October period).

I will go further in detail on this, once we make an update of LM Portfolio

Monday, December 7, 2009

Coawabanga...

Hello everyone. Not much to add regarding the indices front. They remain at the same juncture pretty much and long-term I am still bearish. There are a few developments though in other assets like EURUSD, Gold, AUDUSD and the Dollar Index, which to me is becoming the most relevant asset to merit a close watch. As I said a few weeks ago, it's all about the dollar...

S&P remains the same juncture... just under the 50% Fib and look at the divergences going on - this is a different indicator than the last few weeks:

EURUSD sports the same divergences, and also broke the trendline that was supporting it a few days ago...

Add that to the major sell off last week, but most importantly the characteristics of the sell off... Classic textbook Elliott Wave form with 5 waves down as you can see in the picture... so at least a deeper correction is on the cards... a correction would dump EURUSD into the 1.43 area, while a reversal would be the start of the decline under last year's low.

AUDUSD has many resemblances to EURUSD. In fact, AUDUSD was the first pair to sport 5 waves down a week or more ago if I recall correctly. This too, should have more downside potential. A trading plan here, alike EURUSD would be to short on the rallies like a 38 or 50% Fibonacci retracement of friday's decline.

Now, let's move to GOLD. That little shinny yellow object that most of us love. Who doesn't ? :-D

Anyways, here to we have MAJOR divergences, and for the first time in a long time we have a textbook Elliott Wave form decline, sporting 5 waves down. It can't get cleaner than this. Again the plan here would be to wait for a little rally into the 38-50 Fibonacci area and then getting in.

Oh I almost forgot... one more thing. Remember my charts on USD Index? I've been favoring a big rally coming on USD. Lately, it seems USD has found a bid. Let's see if it can continue this strong. It's imperative to remain strong and break those resistances. But here's what I prep for you guys...

An ABC flat looks like this:

Now let's take a peek into USD Index...

Now tell me I'm not seeing things... any resemblance with real life is purely coincidental. :-D

EDIT:

I want to make an update on something I forgot to talk about. Last Friday's Non-Farm Payrolls. I saw a lot of cheering because the report was so much better than expected and how the unemployment dropped from 10.2% to 10%. Well, I don't see a reason for cheering such numbers. And why is that?

We have to take into account the season we're in. I don't know how it is in USA - well actually I do - but here in Portugal, stores during November start to recruit a lot of workers for the Christmas season, but then what? They get dumped in January pretty much. So I don't see much reason to cheer... the drop in the numbers of NFP were ONLY because of the hiring due to the TEMPORARY hiring companies ensued for Christmas. Wal-Mart alone accounted for the creation of around 65,000 temporary jobs! So we know how this will be once all those temp workers get dumped for unemployment again...

And we all know how BLS tracks unemployment figures ... here's something you should watch:

Are you unemployed?

S&P remains the same juncture... just under the 50% Fib and look at the divergences going on - this is a different indicator than the last few weeks: