Though we didn't make money today, we still managed to outperform the market by a mere +0.06%.

I'm happy with the performance so far, and I hope the overlay "hedging" strategy helps you sleep better at night. Let me know, after the fact, since we've had the last couple months have been down months, if the strategy benefited you at any level. Let me know your feedback.

So far, we've been able to maintain the profits, while the market has been going down.

Another short stat for the portfolio is:

- Market return Year-to-Date: -7.35%

- LMP return Year-to-Date: +7.8%

In my opinion for such a low transaction portfolio this is a huge over performance, we are not trading, our stocks have been held around 12-13 months ! I'm happy with this...

I wish big returns for all of us in the coming years...

And to all Americans out there reading myBullmarket, I wish you a happy 4th of July !!

Showing posts with label System. Show all posts

Showing posts with label System. Show all posts

Friday, July 2, 2010

Wednesday, June 30, 2010

LMP Update v2

We are still postponing the purchase of the new companies, which still weren't announced. They will be soon.

Apart from that, the portfolio is doing wonders so to speak. The last batch of stocks that that were bought a year ago, and sold yesterday, the average return translated into +18% (not including dividends) while the S&P during the same time period (June 2009 - June 2010) made +12.5%.

Of the 6 stocks though, the outperformance clearly came from 2 companies only, but that is to be expected. Some will underperform (usually the majority) while a couple ones will make heavy over performance covering all the underperformance of the other stocks and then some making it possible to beat the market.

Also I'm glad we did make the change on the strategy as well. The hedging part of our portfolio, where I use a longer term version of "Zé Manel" serving as an overlay to neutral our portfolio by shorting the market as a whole, while keeping our beloved stocks. Since we first started this overlay, our overperformance increased from +46% to +60% as of today !

This means that our stocks as a whole have been falling less than the market as a whole, and at times even being able to make a bit of money. Of course under this strategy the goal is not to make money, but to hedge our portfolio of market risk and to maintain our gains and for us to be dependent on our stock picks exclusively.

For example, today which was a down day for the market with more than 1% down, we actually managed to gain a few dollars with an up day of our portfolio of +0.50% ... I wish all days could be like this :) it won't... but we should keep our eyes on the big picture, and I believe we really do have a winning strategy here

EDIT: The portfolio as of today

Apart from that, the portfolio is doing wonders so to speak. The last batch of stocks that that were bought a year ago, and sold yesterday, the average return translated into +18% (not including dividends) while the S&P during the same time period (June 2009 - June 2010) made +12.5%.

Of the 6 stocks though, the outperformance clearly came from 2 companies only, but that is to be expected. Some will underperform (usually the majority) while a couple ones will make heavy over performance covering all the underperformance of the other stocks and then some making it possible to beat the market.

Also I'm glad we did make the change on the strategy as well. The hedging part of our portfolio, where I use a longer term version of "Zé Manel" serving as an overlay to neutral our portfolio by shorting the market as a whole, while keeping our beloved stocks. Since we first started this overlay, our overperformance increased from +46% to +60% as of today !

This means that our stocks as a whole have been falling less than the market as a whole, and at times even being able to make a bit of money. Of course under this strategy the goal is not to make money, but to hedge our portfolio of market risk and to maintain our gains and for us to be dependent on our stock picks exclusively.

For example, today which was a down day for the market with more than 1% down, we actually managed to gain a few dollars with an up day of our portfolio of +0.50% ... I wish all days could be like this :) it won't... but we should keep our eyes on the big picture, and I believe we really do have a winning strategy here

EDIT: The portfolio as of today

Monday, April 26, 2010

For my fellow portuguese investors...

For my fellow portuguese investors it seems the PSI-20 is not looking for a rest at all.

After a sell signal last week, it has already gone down 6.7%, and as far I can see there is no reason at all to be investing in PSI yet.

EDP-Renováveis which is the third biggest company in terms of renewable energies in the world, is not attractive at all at this moment and I can't understand how so many portuguese investors love to buy a falling knife...

I don't know when will this correction on PSI-20 will end, hey, it may well be the new leg of a bear market.

And just for curiosity, if past holds any truth, PSI-20 index, since its' creation has been an excellent prognosticator of what is to come to the world indexes. Usually the portuguese index breaks first than the more renown indexes such as S&P 500, etc.

But this time... this time may be different...

After a sell signal last week, it has already gone down 6.7%, and as far I can see there is no reason at all to be investing in PSI yet.

EDP-Renováveis which is the third biggest company in terms of renewable energies in the world, is not attractive at all at this moment and I can't understand how so many portuguese investors love to buy a falling knife...

I don't know when will this correction on PSI-20 will end, hey, it may well be the new leg of a bear market.

And just for curiosity, if past holds any truth, PSI-20 index, since its' creation has been an excellent prognosticator of what is to come to the world indexes. Usually the portuguese index breaks first than the more renown indexes such as S&P 500, etc.

But this time... this time may be different...

Sunday, January 17, 2010

Long time no see...

Good weekend everyone...

There have been a lack of posts lately from my part. Today I'm updating a few foreign charts.

Our Sensex from India and introducing the brazilian Bovespa. I'm also very very bullish in this one for a long time. I've said it before that apart from India, I think a few other countries in Southeast Asia are in bull markets in my opinion as well. Those are South Korea and Singapore and also Indonesia, and add that to Brazil.

Brazil actually I believe it's very similar to India. We're in a secular bull market, and this rise is only the start of a Primary 3rd Wave in EW terms. So there's lot of bull market to run in these ones. My opinion is these SECULAR bulls will last around 20 years. Of course we'll have simple bear markets in between, which I've made clear in India for example. I think we'll have a simple Bear Market around the 55,000 level in around 7 years or so. It will be something like this past bear market OR due to the alternation rule in EW terms, some kind of a sideways market (a triangle) very much alike the Dow Jones in the 70's.

But that is still very far away.

My opinion for the last few months was that a top in India was to be reached around the 18,000 level for the end of Wave (1). Indeed it seems to be struggling around that area, and it seems Wave (1) is pretty much finished.

Now the problem is 2nd Waves can retrace deep. I wouldn't be surprised for the coming 2nd Waves in the markets I consider bullish, to be deep, especially considering what I expect from SP500 and other markets. I expect new lows on Western countries' markets, so in this case the scenario could be, all bullish markets to follow SP500 in tandem until a certain point and then diverging.

The bull ones going up, and SP500 and most european countries keep declining.

Still, for long term my bias goes to keep adding capital every month to a fund exposed to these markets (Brazil, India, etc) much alike a passive investing strategy.

As long as these graphs don't show a SELL signal, I wouldn't be worried. If they happen to show a sell signal, I'll issue it here right away, and the prudent thing to do may be to get out. But so far so good, nothing is looking grim on the horizon...

Both trends are up both on Daily and Weekly charts, so we should be good :)

The LMP portfolio is also looking good, and from now on my screeners I will incorporate companies from India and Brazil as long as they also trade in NYSE. We should get a few goodies by incorporating both those markets.

There have been a lack of posts lately from my part. Today I'm updating a few foreign charts.

Our Sensex from India and introducing the brazilian Bovespa. I'm also very very bullish in this one for a long time. I've said it before that apart from India, I think a few other countries in Southeast Asia are in bull markets in my opinion as well. Those are South Korea and Singapore and also Indonesia, and add that to Brazil.

Brazil actually I believe it's very similar to India. We're in a secular bull market, and this rise is only the start of a Primary 3rd Wave in EW terms. So there's lot of bull market to run in these ones. My opinion is these SECULAR bulls will last around 20 years. Of course we'll have simple bear markets in between, which I've made clear in India for example. I think we'll have a simple Bear Market around the 55,000 level in around 7 years or so. It will be something like this past bear market OR due to the alternation rule in EW terms, some kind of a sideways market (a triangle) very much alike the Dow Jones in the 70's.

But that is still very far away.

My opinion for the last few months was that a top in India was to be reached around the 18,000 level for the end of Wave (1). Indeed it seems to be struggling around that area, and it seems Wave (1) is pretty much finished.

Now the problem is 2nd Waves can retrace deep. I wouldn't be surprised for the coming 2nd Waves in the markets I consider bullish, to be deep, especially considering what I expect from SP500 and other markets. I expect new lows on Western countries' markets, so in this case the scenario could be, all bullish markets to follow SP500 in tandem until a certain point and then diverging.

The bull ones going up, and SP500 and most european countries keep declining.

Still, for long term my bias goes to keep adding capital every month to a fund exposed to these markets (Brazil, India, etc) much alike a passive investing strategy.

As long as these graphs don't show a SELL signal, I wouldn't be worried. If they happen to show a sell signal, I'll issue it here right away, and the prudent thing to do may be to get out. But so far so good, nothing is looking grim on the horizon...

Both trends are up both on Daily and Weekly charts, so we should be good :)

The LMP portfolio is also looking good, and from now on my screeners I will incorporate companies from India and Brazil as long as they also trade in NYSE. We should get a few goodies by incorporating both those markets.

Sunday, January 3, 2010

2010 resolutions and LMT update

Hello everyone. Happy new year :-D

I hope everyone spent a good time during these holidays. 2010 is now in front of us, and it should be a tough year economically speaking in my opinion. During this year we'll have a lot of possible catalysts to reignite what we experienced in 2008. What happened in 2008 was mostly mainstreamed in the stock markets and the sub-prime factor, this year though the catalysts will come from the mother of all markets: sovereign debt. Greece, is in deep trouble, and no matter what the IMF says or their prime minister they soon will have to either default on their debt or to get intervention from the exterior, which in my opinion is a matter of months in order to happen. Portugal and Ireland would soon follow Greece's footsteps, unfortunately for me because I live in this beautiful country but is managed in such a bad way... sooner or later we will also have to recur to foreign help.

For the USD I think it will be a rosy year indeed. What I see from USD right now is a lot of strength signals and it should lead the index towards the 90-95 level. At least it's what I expect.

Now regarding the Low Maintenance Portfolio. I know we're a few days behind, since I didn't make any new posts the last 9 days. The change date should've been the 26th, but oh well, just a few days behind won't make a single dent on our expectations.

So for tomorrow we're selling from the Portfolio the following stocks:

- Terra Industries

- Valco Energy

- Garmin

- Time Warner (this was our star stock for the past year with 200+% in profits)

- Marvel (which was sold when Disney made the announcement)

The capital coming from the sales of these stocks will be allocated into 5-6 new stocks equally. If you're new and have no stocks or have only the stocks from past September, then 25% of your initial capital should be allocated equally between 5-6 stocks.

So the new stocks will be:

- Cherokee (CHKE)

- Aeropostale Inc (ARO) - (can't believe how I didn't remember this one before... I bought a lot of clothes in this store when I was in the States...although in EW terms and techically I don't like it, but hey this is a fundamental/value based strategy not TA)

- FluorCorp (FLR)

-

- Sturm, Ruger & Co. Inc. (RGR)

...and finally:

- Gamestop. This one already is in our portfolio and once again made it through our screening. Since I believe in the company, and since it still shows up as one of the best companies around, then we can save ourselves some transaction costs and keep this one in the portfolio.

So in summary, we have 3 small caps and 3 medium caps (one that already was in our portfolio).

Let's hope that all of these turn out like Time Warner.

Note: Prices of sale and purchase taken into consideration will be tomorrow's OPENING price.

EDIT:

There is a problem with this post. I made a mistake to name Graham Corp. (GHM) since it was already in our portfolio from the previous quarter. Therefore we're still missing one stock. This stock is Energy Recovery Inc (ERII).

I will consider tomorrow's opening price for this pick, so the results provided on this site could be easily attainable for anyone tracking it.

Once again I apologize for the mistake

Friday, December 18, 2009

Today's post is a bit different and what I've been working on lately.

I've extensively been backtesting the LMT Portfolio premises. I have composed 100 random portfolios in which the stocks composing them all would fit within LMT parameters. The data totally beat the S&P. Both buy and hold for S&P, as well as passive investing with S&P (buy and hold + adding 10% of equity into the market every year).

Both got crushed from LMT. All 5 year rolling periods are positive for LMT unlike S&P.

Here are both charts worth taking a look in my opinion. One might say that the portfolio took advantage of the roaring 90's. True, but even so, starting a portfolio under the same characteristics at 2000 top, while S&P managed to pretty much be flat, LMT would manage 16% per year and that's taking into consideration the bear market.

This first chart does not add 10% of new cash into S&P Buy and Hold. But they don't differ much... the dash green line is what ~I consider an excellent long term goal.

This pretty much sums to a 20-to-1 harsh beating of LMTP versus the market. Should we take a large margin of safety, I would say a 5-to-1 would still be excellent.

Don't forget to check then, December 26th some of our stocks will be replaced by newer ones.

I'm gonna need my sleep now.

BTW, last night I experienced my first earthquake ... a 6.1 Richter scale quake. It sure was daunting...

I've extensively been backtesting the LMT Portfolio premises. I have composed 100 random portfolios in which the stocks composing them all would fit within LMT parameters. The data totally beat the S&P. Both buy and hold for S&P, as well as passive investing with S&P (buy and hold + adding 10% of equity into the market every year).

Both got crushed from LMT. All 5 year rolling periods are positive for LMT unlike S&P.

Here are both charts worth taking a look in my opinion. One might say that the portfolio took advantage of the roaring 90's. True, but even so, starting a portfolio under the same characteristics at 2000 top, while S&P managed to pretty much be flat, LMT would manage 16% per year and that's taking into consideration the bear market.

This first chart does not add 10% of new cash into S&P Buy and Hold. But they don't differ much... the dash green line is what ~I consider an excellent long term goal.

This pretty much sums to a 20-to-1 harsh beating of LMTP versus the market. Should we take a large margin of safety, I would say a 5-to-1 would still be excellent.

Don't forget to check then, December 26th some of our stocks will be replaced by newer ones.

I'm gonna need my sleep now.

BTW, last night I experienced my first earthquake ... a 6.1 Richter scale quake. It sure was daunting...

Friday, November 20, 2009

Rolling over?

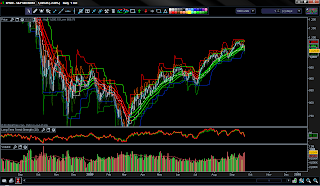

S&P rolling over?

For the first time since the bottom at 1030's a few weeks back, we now have a sell signal. Let's see how this one develops.

Meanwhile the dollar is strengthening. Today there was a glitch shooting the USD Index up almost 10%. I wished it were true I'd be up like 200% in a blink of an eye eheheh...

Anyways, here too the bottom seems to be rolling up.

A lot of divergences going on, extreme bearishness from the public and market participants, and also the EW count calls for a move up. As you know I am expecting a big rally for USD, maybe as strong as +50% on the Index.

Of course, although I'm very bullish on the dollar I will only start buying once it passes through the 76 area or whenever I get a signal from my systems (which on the short term I already am long the dollar).

For the first time since the bottom at 1030's a few weeks back, we now have a sell signal. Let's see how this one develops.

Meanwhile the dollar is strengthening. Today there was a glitch shooting the USD Index up almost 10%. I wished it were true I'd be up like 200% in a blink of an eye eheheh...

Anyways, here too the bottom seems to be rolling up.

A lot of divergences going on, extreme bearishness from the public and market participants, and also the EW count calls for a move up. As you know I am expecting a big rally for USD, maybe as strong as +50% on the Index.

Monday, November 16, 2009

Weekend update

Not much to add after last week. We're still under the 1100 resistance area in the S&P500. In EW terms, I cannot make at this juncture a count.

There are times when we need to step back and wait a bit, for more information in order to make a correct assessment. Trying to force perspectives into our counts is foolish. One should know when to step back and admit that for now there's no need to try to come up with a count that has a low reliability.

To me, we're still in a topping process, especially with the recent market correlations that are kind of broken right now. I'm talking DAX and other european indexes, as well as the higher beta US indexes such as the Dow Transports and Russell 2000.

DJT is considered to be the leader of the market, and so far it has struggled and is still far away from its' highs. This week is utterly decisive.

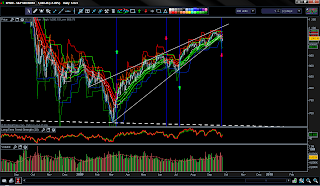

As far as Ze Manel goes, well stay with the trend... this is an intraday chart:

These are the German DAX and the PSI-20 (the portuguese index)... both are more than lagging the current uptrend on the S&P and the DOW JONES.

As far as the higher beta US indexes go, here's a snapshot of Russell 2000

Cheers!

P.S: I want to thank you for the adherence to EWI's free week. Definitely I wasn't expecting such a surge on participation. I hope you all took advantage of it and gathered some of their premium services. Don't worry, now that it's over you still have a lot of free stuff inside their members page, so to all of you that missed it you can still register and have access to their free stuff. And the free week from EWI is a common occurrence from them, so keep your eyes open.

There are times when we need to step back and wait a bit, for more information in order to make a correct assessment. Trying to force perspectives into our counts is foolish. One should know when to step back and admit that for now there's no need to try to come up with a count that has a low reliability.

To me, we're still in a topping process, especially with the recent market correlations that are kind of broken right now. I'm talking DAX and other european indexes, as well as the higher beta US indexes such as the Dow Transports and Russell 2000.

DJT is considered to be the leader of the market, and so far it has struggled and is still far away from its' highs. This week is utterly decisive.

As far as Ze Manel goes, well stay with the trend... this is an intraday chart:

These are the German DAX and the PSI-20 (the portuguese index)... both are more than lagging the current uptrend on the S&P and the DOW JONES.

As far as the higher beta US indexes go, here's a snapshot of Russell 2000

Cheers!

P.S: I want to thank you for the adherence to EWI's free week. Definitely I wasn't expecting such a surge on participation. I hope you all took advantage of it and gathered some of their premium services. Don't worry, now that it's over you still have a lot of free stuff inside their members page, so to all of you that missed it you can still register and have access to their free stuff. And the free week from EWI is a common occurrence from them, so keep your eyes open.

Thursday, November 12, 2009

Chaos reign...

No I am not talking about the markets, but my home actually... Absolute chaos in here. Still very primitive, and so many things we need to place into the right spots... one room is still with renovations ongoing. Same goes for the kitchen. Furniture is pretty much all confined to the living room and that thing is worse walking around than an elephant at a porcelain shop !!

Well, moving on, I now have internet, may I say super dupper fast internet connection with fiber optic with a symmetric 150Mbps both download and upload... oh yeah.

Meanwhile the markets... although both DJI and S&P have risen to new highs, I see the market very weak. I think we're about to roll over.

While DJI and S&P made new highs, all higher beta indexes failed to do so. I'm talking Russell 2000, Banking Index, Dow Jones Transportation and so on... they are all within the 61.8 Fibonacci expected from a correction.

The european markets are also very weak and failed to make new highs. German DAX fell 10% during last week's decline from the highs to the bottom while S&P declined by 7%. So with this rally the DAX is still 5% away more or less from the highs while the S&P just made a new high today...

This kind of divergence among several markets usually happen at tops, meaning a lot of distribution is being made from strong hands to the weak ones.

It is my opinion we are near to roll over... supporting is once again the USD Index, which made new lows during this past week while the major pairs all failed to make new highs - i.e. EURUSD, GBPUSD, USDCAD (didn't make new lows).

So some pretty nasty broken market internals going on...

Now here's a chart, although I don't trade this time frame, it does indeed look promising, with a sell signal around the 1097 area:

Monday, October 5, 2009

Presidential Monday Rubdown

Today was a holiday here in Portugal. The day where Portugal turned from a monarchy into a republic. October 5th of 1910, one year short of a century.

It was not until a year later that my great grandfather would become the 1st elected President of my country. True story!

Apart from that, let's check the S&P. This little decline somehow feels different, the bulls have been really cocky the past couple days, and are pretty sure we'll see new highs. I don't say that's impossible, but the fact that the mood is different makes me thing otherwise. Also a few charts look different was well.

Zé Manel also gave a SELL signal past friday on the daily charts- which the last time it did was June 16th, and the wedge is more than broken right now and I wouldn't be surprised to see the index go test the underside of the bottom of the wedge...

Also take a look at the last chart at the bottom, from Mole at EvilSpeculator. Something different in the cards? I don't know, just putting ideas on the table... also if anyone would want to know Zé Manel system would indicate to go short at market with a stop at 1071'ish.

Don't get me wrong, I'm not saying it's impossible to go higher, I actually am very cautious on both sides, although I would lean a bit more into the bearish case, even if we rise a few more points in order to test the broken trendline.

Cheers everyone

It was not until a year later that my great grandfather would become the 1st elected President of my country. True story!

Apart from that, let's check the S&P. This little decline somehow feels different, the bulls have been really cocky the past couple days, and are pretty sure we'll see new highs. I don't say that's impossible, but the fact that the mood is different makes me thing otherwise. Also a few charts look different was well.

Zé Manel also gave a SELL signal past friday on the daily charts- which the last time it did was June 16th, and the wedge is more than broken right now and I wouldn't be surprised to see the index go test the underside of the bottom of the wedge...

Also take a look at the last chart at the bottom, from Mole at EvilSpeculator. Something different in the cards? I don't know, just putting ideas on the table... also if anyone would want to know Zé Manel system would indicate to go short at market with a stop at 1071'ish.

Don't get me wrong, I'm not saying it's impossible to go higher, I actually am very cautious on both sides, although I would lean a bit more into the bearish case, even if we rise a few more points in order to test the broken trendline.

Friday, October 2, 2009

Thursday, September 24, 2009

India Recap

Regarding India I don't have the Sensex on the database of this program, so the next thing most similar is the ETF's in this case MSCI India.

So far so good...

Regarding the last post, here it is one of the best performers from the list of the screening tool... It issue a buy at 0.57 USD at it stands today at 13.22 USD, a 2219% rise!

I know that in hindsight is easy, but with the screening tool and with the system we'll have the chances from time to time to grab these suckers. Even if it only happens once in 10 or more years I'd be more than happy.

So far so good...

Regarding the last post, here it is one of the best performers from the list of the screening tool... It issue a buy at 0.57 USD at it stands today at 13.22 USD, a 2219% rise!

I know that in hindsight is easy, but with the screening tool and with the system we'll have the chances from time to time to grab these suckers. Even if it only happens once in 10 or more years I'd be more than happy.

Screening tool

For the more aggressive portfolio - where the holding period is shorter and also we short stocks - I have been trying to work on some screeners to scan the entire NYSE, AMEX and NASDAQ universe so that they fit the criteria...

With that in mind, here are some results from the Beta version of the screening tool

With that in mind, here are some results from the Beta version of the screening tool

While this screener is only as of today only technical, I do intend for long positions to make a cross from this screener with the screener of LMT portfolio... that would be the cherry on the top of the cake. Finding good fundamental companies and then with the help of the system buying them on strength... who knows, with good fundamental companies the program may issue a buy signal and never issuing a sell signal until 2000% or more.This should work as a powerful combo...

Subscribe to:

Posts (Atom)

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com

.png)