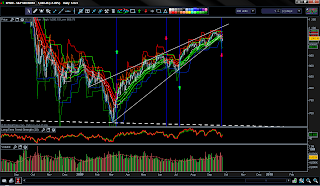

Today behaved as expected. We did indeed test the underside of the wedge and it reacted instantly.

Now the million dollar question... Will it turn right here or keep on going?

Honestly I have no idea. Today's internal metrics were very bullish with Advance/Declines north of 8 to 1.

I actually re-entered my shorts that I dumped at 1020 today. I'm not very confident at the moment but I will pay to see if the bulls can make it go higher, I'm using Zé Manel's stop

Someone brought to my attention, on some other blogs using my graphs. I don't mind people using my graphs as long as they credit me. I would appreciate that if you do use them, please make a little comment crediting me or refer to this blog.

Thank you

Tuesday, October 6, 2009

Monday, October 5, 2009

Presidential Monday Rubdown

Today was a holiday here in Portugal. The day where Portugal turned from a monarchy into a republic. October 5th of 1910, one year short of a century.

It was not until a year later that my great grandfather would become the 1st elected President of my country. True story!

Apart from that, let's check the S&P. This little decline somehow feels different, the bulls have been really cocky the past couple days, and are pretty sure we'll see new highs. I don't say that's impossible, but the fact that the mood is different makes me thing otherwise. Also a few charts look different was well.

Zé Manel also gave a SELL signal past friday on the daily charts- which the last time it did was June 16th, and the wedge is more than broken right now and I wouldn't be surprised to see the index go test the underside of the bottom of the wedge...

Also take a look at the last chart at the bottom, from Mole at EvilSpeculator. Something different in the cards? I don't know, just putting ideas on the table... also if anyone would want to know Zé Manel system would indicate to go short at market with a stop at 1071'ish.

Don't get me wrong, I'm not saying it's impossible to go higher, I actually am very cautious on both sides, although I would lean a bit more into the bearish case, even if we rise a few more points in order to test the broken trendline.

Cheers everyone

It was not until a year later that my great grandfather would become the 1st elected President of my country. True story!

Apart from that, let's check the S&P. This little decline somehow feels different, the bulls have been really cocky the past couple days, and are pretty sure we'll see new highs. I don't say that's impossible, but the fact that the mood is different makes me thing otherwise. Also a few charts look different was well.

Zé Manel also gave a SELL signal past friday on the daily charts- which the last time it did was June 16th, and the wedge is more than broken right now and I wouldn't be surprised to see the index go test the underside of the bottom of the wedge...

Also take a look at the last chart at the bottom, from Mole at EvilSpeculator. Something different in the cards? I don't know, just putting ideas on the table... also if anyone would want to know Zé Manel system would indicate to go short at market with a stop at 1071'ish.

Don't get me wrong, I'm not saying it's impossible to go higher, I actually am very cautious on both sides, although I would lean a bit more into the bearish case, even if we rise a few more points in order to test the broken trendline.

Friday, October 2, 2009

Thursday, October 1, 2009

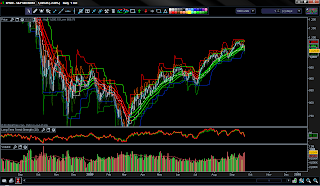

Today's update is directed to show some signs that the top may already be in.

First off we'll start with monthly and weekly charts from DJI.

From those charts you can see how the blue channel, the top line is now resistance. We broke that channel back in last October, and it was when we crashed. We have now bumped into that area. Not only that but check weekly update and you have resistances (drew in white) which in EW corresponds to the previous 4th wave of lesser degree - a common stop for corrections. Not only that but check the red trendline, which is the BEAR MARKET trendline from the top, also lays in that area.

Also the top of the wedge... which can clearly be seen in the S&P graph.

We undercut also today the bottom of the wedge, which is a really bad sign for bulls...

I would give some more leeway in order for the index to try and close above the white trendline again before calling it a confirmation... but so far evidence foretells a bigger correction even if this is not P3.

Check pics:

Not only that, but the USD is showing signs that it has bottomed

First off we'll start with monthly and weekly charts from DJI.

From those charts you can see how the blue channel, the top line is now resistance. We broke that channel back in last October, and it was when we crashed. We have now bumped into that area. Not only that but check weekly update and you have resistances (drew in white) which in EW corresponds to the previous 4th wave of lesser degree - a common stop for corrections. Not only that but check the red trendline, which is the BEAR MARKET trendline from the top, also lays in that area.

Also the top of the wedge... which can clearly be seen in the S&P graph.

We undercut also today the bottom of the wedge, which is a really bad sign for bulls...

I would give some more leeway in order for the index to try and close above the white trendline again before calling it a confirmation... but so far evidence foretells a bigger correction even if this is not P3.

Check pics:

Not only that, but the USD is showing signs that it has bottomed

Subscribe to:

Posts (Atom)

Live Economic Calendar Powered by the Forex Trading Portal Forexpros.com